Choosing the proper legal framework is the first step in starting a business in India, and the Private Limited Company (Pvt Ltd) is still one of the most well-liked and reliable options for entrepreneurs, startups, and expanding enterprises. A Private Limited Company, which is regulated by the Companies Act, 2013, has the advantages of limited liability, a separate legal identity, continuous succession, and financial accessibility. Registering a company not only provides your business with a formal framework, but also increases its trustworthiness, safeguards your brand, and simplifies regulatory compliance. Registering as a Pvt Ltd firm is a wise first step whether you intend to create a scalable business, entice investors, or grow your operations over the long run. This article offers a step-by-step guide on how to register a Private Limited Company, covering everything from paperwork and eligibility to online form filing and post-incorporation compliance.

Eligibility Criteria for the Registration

To initiate the incorporation of a Private Limited Company in India, certain foundational conditions must be satisfied. These include key elements such as the minimum number of shareholders and directors, a distinct and permissible company name, a valid registered office address, and an appropriate capital structure. In addition, it is mandatory for at least one proposed director to hold a Class 3 Digital Signature Certificate (DSC). This DSC is essential for electronically signing the incorporation application and all supporting forms filed with the Ministry of Corporate Affairs (MCA).

Minimum Number of Director required

A Private Limited Company is required by Section 3(1)(b) of the Companies Act of 2013 to have the following: A minimum of two stockholders and two directors at the time of incorporation. It is impossible for one person to perform both roles (i.e., two separate people are required). According to Section 2(68) of the Act, a private business may have no more than 200 shareholders. At the time of their appointment, directors must give their consent in Form DIR-2 and must not be deemed ineligible by Section 164.

Resident Director appointment

According to Section 149(3) of the Companies Act, every company must have at least one director who is a resident of India. If a person has resided in India for a minimum of 182 days throughout the previous financial year, they are deemed to be a "resident." In order for the business to comply with legal and regulatory obligations, this requirement mandates that it maintains a physical presence there.

Directors' Legal Standing and Authority

The sole candidates for directors are natural people, which is to say individual human beings. The Indian Contract Act, 1872, stipulates that directors must be qualified to enter into contracts. This includes being sane, not bankrupt, and not prohibited by law. Eighteen is the minimum age for becoming a director. The Articles of Association set no upper age restriction unless specifically stated elsewhere.

No Minimum Capital Requirement

The previous Companies Act of 1956 mandated a minimum paid-up capital; however, the Companies Act of 2013 has eliminated this stipulation. Currently: There is no compulsory minimum capital requirement for the establishment of a private limited company. The promoters may incorporate the company with any amount of capital they choose. Nonetheless, the capital structure must be revealed at the time of incorporation and can be augmented after registration through appropriate filings.

Choosing a Legal and Clearly Defined Business Objective

The intended company is required to specify its primary business activity at the time of incorporation. The object clause must be: Clearly articulated and compliant with Indian law Recognizable by selecting an appropriate National Industrial Classification (NIC) Code Not forbidden by law (for instance, chit fund or Nidhi activities without special authorization) An unclear or illegal objective could result in rejection during the incorporation process.

Availability of a Registered Office in India

According to Section 12 of the Act, a company is required to maintain a registered office address in India that is able to receive official communications and notices. The proof of address (for instance, an electricity bill) should not be older than 2 months and must be accompanied by a No Objection Certificate (NOC) from the owner if the premises are leased. Even if the address is provisional at the time of incorporation, the definitive address must be confirmed by submitting INC-22 within 30 days following incorporation.

Distinct and Acceptable Corporate Title

Incorporation is contingent upon the endorsement of the suggested corporate title by the Central Registration Centre (CRC) of the Ministry of Corporate Affairs (MCA). The title must: Be distinct, significant, and not identical or excessively similar to an existing corporation or Limited Liability Partnership (LLP) Not contravene the Emblems and Names (Prevention of Improper Use) Act, 1950 Adhere to Rule 8 of the Companies (Incorporation) Rules, 2014 Refrain from utilizing restricted terms such as "Government", "Bank", "Stock Exchange" unless explicitly authorized Applicants are encouraged to perform a Trademark Public Search and verify availability on the MCA portal prior to submitting an application under SPICe+ Part A.

Benefits of Registering a Private Limited Company

The establishment of a business entity as a Private Limited Company in accordance with the provisions of the Companies Act, 2013 offers numerous statutory, structural, and commercial benefits. This legal structure is particularly advantageous for promoters who desire limited liability, corporate identity, regulatory acknowledgment, and improved scalability. Below are the key legal and operational advantages provided to a private limited company:

Limited Liability of Members

A core principle of corporate law is the limitation of liability. In a private limited company, shareholders' liability is confined to the unpaid portion of their shares [Section 2(22)]. This provision safeguards the personal assets of members from any losses, debts, or liabilities that the company may incur during its operations.

Separate Legal Entity

Upon incorporation, the company attains the designation of a separate legal entity, distinct from its shareholders and directors, as established in Salomon v. Salomon & Co. Ltd. and reaffirmed by Indian courts. It is capable of holding property in its own name, entering into contracts, and engaging in legal actions as an independent entity. This separation safeguards individuals from corporate liabilities and enables a continuous legal existence.

Perpetual Succession

A company established under Indian legislation benefits from perpetual succession, signifying that its existence remains intact despite the death, incapacity, retirement, or insolvency of its members or directors. This principle is enshrined in Section 9 of the Companies Act, 2013, facilitating seamless continuity of operations.

Structured Corporate Governance

Private limited companies must adhere to internal management controls and statutory governance obligations, which include, but are not limited to: Regularly convening Board Meetings (Section 173) Maintaining statutory registers and records (Section 88) Ensuring compliance with disclosure requirements and submitting financial statements to the Registrar of Companies (ROC) This framework promotes a system of transparent, accountable, and auditable operations a characteristic that is often positively regarded by investors, regulators, and financial institutions.

Improved Capacity to Generate Capital

A private limited company, due to its organized structure, can raise capital through: Private placements of shares [Section 42] Rights issues to current members Preferential allotments and the issuance of debentures Although public offerings are limited, the legal framework offers sufficient flexibility to obtain funding from venture capitalists, angel investors, and private equity firms all of whom favour the corporate structure for due diligence and exit rights.

Documents required for filling SPICE+

-

Proof of office address ( rent agreement/sale deed)

-

Copies of utility bills not older than 2 months (electricity/water/gas bill)

-

An affidavit on a stamp paper is to be given by all subscriber to state their willingness to become the shareholder of the company.

-

NOC from the owner of the company if the office is rented/leased.

-

Copy of approval in case the proposed name of the company contains any words or expression that require approval from Central Government

-

If the proposed name is based on a Trademark or the application for the same is pending, then it is mandatory to attach the trademark registration certificate or application copy.

-

In case the Director do not have a DIN it is mandatory to attach proof of identity and address proof

-

Passport size photograph.

-

If the director/shareholder is a Foreign national

-

Passport

-

Address proof- driving license/residence card/bank statement.

How to register?

-

Obtain DSC ( Digital Signature Certificate)

-

Apply for DIN ( Director Identification Number)

-

Name approval

-

Form SPICE+ (INC 32)

-

E-MOA (INC 33) E-AOA (INC 34)

-

Apply for PAN & TAN.

Step by Step procedure for the incorporation of the Private Company.

The establishment of a Private Limited Company in India is regulated by the Companies Act of 2013 and is overseen by the Ministry of Corporate Affairs (MCA). The incorporation procedure is now entirely online and centralized via the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) system, which consolidates multiple statutory registrations into a single web-based application. Below is a detailed step-by-step guide to the incorporation process, encompassing portals, forms, and legal prerequisites:

Step 1. Acquire a Digital Signature Certificate (DSC) for Directors and Subscribers

Each proposed director and shareholder (subscriber to the Memorandum) is required to obtain a Class 3 Digital Signature Certificate (DSC). The DSC is necessary for digitally signing incorporation forms and is provided by a licensed Certifying Authority (CA) such as e-Mudra, Sify, or NSDL. Required documents include: PAN, Aadhaar, a photograph, and verification of email/mobile. This is a mandatory requirement. No MCA form can be submitted without a valid DSC.

Step 2. Apply for a Director Identification Number (DIN)

Under Section 153 of the Companies Act, 2013, any individual who wishes to serve as a director in an Indian company is required to obtain a Director Identification Number (DIN). The DIN is now issued directly through the SPICe+ form. At the time of incorporation, a maximum of three new DINs may be applied for. Applicants are required to provide identity proof, address proof, and a photograph, all of which must be self-attested. The DIN is granted following the approval of the incorporation form and is included in the Certificate of Incorporation. If an individual already possesses a DIN, it must be disclosed in the SPICe+ form. Submitting duplicate applications is not allowed.

How to apply for a DIN?

An individual intending to become a director in an Indian company must obtain a Director Identification Number (DIN) in accordance with the provisions of the Companies Act, 2013. A DIN can be acquired in two legally recognised ways. Firstly, in the case of a new company incorporation, the DIN is applied for and allotted through the SPICe+ (INC-32) form, wherein up to three directors can obtain their DINs as part of the incorporation process. This integrated e-form is filed online on the Ministry of Corporate Affairs (MCA) portal, along with identity proof, address proof, and a valid Class 3 Digital Signature Certificate (DSC) of each applicant. Secondly, where a person is being appointed as a director in an existing company and does not already possess a DIN, they must file Form DIR-3 separately, supported by the company’s board resolution proposing their appointment and duly certified by a practising professional (CA/CS/CMA). In either method, the DIN is allotted by the Central Registration Centre (CRC) after due verification of the documents.

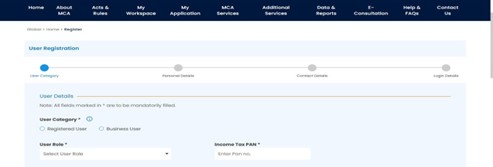

Step 3. Access the MCA Portal

To commence the incorporation process, the applicant is required to visit the official website of the Ministry of Corporate Affairs (MCA) at www.mca.gov.in once you’re on the homepage (as shown in the image)

-

Locate the “Sign in/sign/up” option on the top-right corner of the page.

-

Click on it.

-

After clicking on the Sign in/ Sign up this login page will open now you have proceed by clicking on register if you’re new user and if you’re old user end proceed with your already registered user id and password followed by Captcha you will successful login to V3 portal of MCA.

-

If you don’t have an account click on the ‘Register’ button from the login page you will be redirected to the USER registration page as shown below.

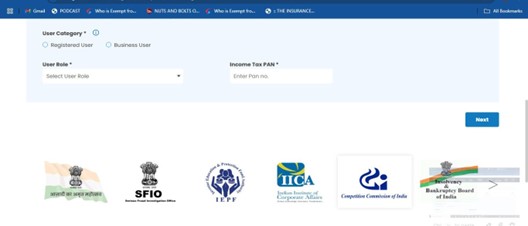

Choose your user category

-

Select either: Registered user (for individuals like professionals, director, etc.) or Business user (for Companies, LLP’s firms etc.)

- Select user role: From the dropdown ,choose the relevant role such as,

-

Director

-

Professional

-

Manager/ authorized representatives etc.

- Enter your income Tax PAN: Fill in your valid PAN number.

-

Once you’ve filled in:

-

User category

-

User role

-

PAN number

-

Click on the next button.

Step 4. File SPICe+ Part A – Name Reservation for the Company

-

Once the user account has been successfully established on the MCA portal, the subsequent step in the company registration process is to commence SPICe+ Part A, which is related to name reservation.

-

This step is a necessary prerequisite to submitting the complete incorporation application. To start,

-

Log into the MCA portal and proceed to MCA Services > Company Services > SPICe+. Click on "New Application" and Choose 'Private Limited Company' from the 'Type of Company' You will then be required to complete SPICe+ Part A, which involves proposing one or two names for the intended company along with the main objects clause a brief description of the primary business activity, which will be included in the Memorandum of Association.

The suggested name must adhere to the standards established under Rule 8 of the Companies (Incorporation) Rules, 2014, which forbid names that are identical to or too closely resemble existing company names, LLP names, trademarks, or names that include offensive or restricted words. It is recommended to conduct a name availability check beforehand using the MCA Name Search Tool as well as the Trademark Public search https://tmrsearch.ipindia.gov.in/tmrpublicsearch/ to prevent rejections or delays. If the name is deemed acceptable, the Central Registration Centre (CRC) of the MCA usually provides approval within 1–2 working days. The sanctioned name remains valid for 20 days, during which the applicant must file SPICe+ Part B to finalize the incorporation process.

Note: If the SPICe+ form is submitted immediately with Part A and Part B together (without prior name reservation), this is referred to as "Direct Incorporation with Name Approval". However, obtaining separate name approval via Part A is generally advisable when the proposed name is crucial for branding or legal reasons.

Step 5. Complete SPICe+ Part B – Filing of Incorporation and Linked Forms

Once the company name receives approval via SPICe+ Part A, the applicant is required to move forward with completing SPICe+ Part B, it constitutes the essential part of the incorporation process as outlined in the Companies Act, 2013. This section necessitates a thorough disclosure of the company's intended structure, including the authorized and subscribed capital, the primary objectives of the company, and details regarding the registered office address. Furthermore, extensive information about the initial directors and shareholders such as their names, DINs (if applicable), PAN, Aadhaar, nationality, and residential address must be provided. The proposed directors and subscribers are also obligated to submit their self-attested identity proofs, address proofs, and recent photographs, and their Digital Signature Certificates (DSCs) must be properly affixed to the appropriate forms.

As part of the integrated incorporation system, SPICe+ Part B must be submitted alongside the following associated forms:

All of these forms are components of the web-based SPICe+ interface and must be completed, validated, and submitted as a single package. It is essential to verify that the uploaded documents are legible, properly signed, and in the required PDF format. After all sections and forms have been filled out and digitally signed, the application may be submitted for pre-scrutiny and the payment of statutory fees. Upon submission, the application will be examined by the Central Registration Centre (CRC) for final approval and the issuance of the Certificate of Incorporation.

Part B of the SPICe+ form offers a range of integrated statutory registrations and services required at the time of company incorporation. These include:

-

Incorporation of the company under the Companies Act, 2013;

-

Allotment of Director Identification Number (DIN) to proposed directors (where applicable);

-

Mandatory issuance of the company’s Permanent Account Number (PAN);

-

Issuance of Tax Deduction and Collection Account Number (TAN);

-

Allotment of Employees’ Provident Fund Organisation (EPFO) registration;

-

Issuance of Employees’ State Insurance Corporation (ESIC) registration;

-

Opening of a mandatory bank account in the name of the company;

-

Profession Tax registration (mandatory for companies having registered offices in Maharashtra, Karnataka, and West Bengal);

-

Optional allotment of Goods and Services Tax Identification Number (GSTIN); and

-

Shops and Establishment registration number for companies with offices located in the National Capital Territory of Delhi.

Step 6. E-MOA + E-AOA

As part of the SPICe+ Part B submission, the applicant must file eMoA (INC-33) and eAoA (INC-34), which are the electronic formats of the Memorandum and Articles of Association. The eMoA outlines the company’s name, registered office, capital structure, and main business objects, while the eAoA governs internal management, including rules relating to directors, meetings, and shareholder rights. These forms must be digitally signed by all subscribers and proposed directors using Class 3 DSCs. For most private companies, submission through e-format is mandatory unless a custom format is required in exceptional cases.

Step 7. Approval of Incorporation and Allotment of CIN

Through SPICE+ form the system will auto generate these forms after the submission of SPICE+. If all the details of the form are duly filed with required document MCA will approve the registration and CIN is alotted.

Post incorporation compliances

-

Apply for GST

-

Open bank account

-

First board meeting within 30 days

-

Appoint statutory auditor

-

Issue share certificates

-

Maintain statutory register

-

File INC-20A ( declaration of commencement of business)

Timeline for Incorporation of a Private Limited Company

The duration needed to establish a Private Limited Company in India can fluctuate based on the precision of documentation, name approval, and the processing times of the MCA. Nevertheless, under typical conditions, the standard timeline is outlined as follows:

Day 1–2: Acquisition of Digital Signature Certificates (DSCs) for all proposed directors and subscribers.

Day 2–4: Reservation of name via SPICe+ Part A (contingent on availability and approval).

Day 4–7: Submission of SPICe+ Part B, eMoA, eAoA, AGILE-PRO-S, and other associated forms.

Day 7–10: Remittance of government fees, verification of forms by MCA, and issuance of the Certificate of Incorporation (COI) along with DIN, PAN, and TAN.

Generally, if all documents are properly prepared and there are no objections or resubmissions, the incorporation process is finalized within 7 to 10 working days from the initiation of the application.

Government Fees for Company Incorporation

The government fees for incorporating a Private Limited Company in India primarily depend on the authorised share capital and the state of incorporation, as stamp duty rates vary across states.

The Ministry of Corporate Affairs (MCA) levies nominal registration charges for companies having authorised capital up to Rs.15 lakhs, with exemptions for companies incorporated as startups or registered under the Startup India initiative.

The standard fees include:

SPICe+ Form Filing Fee: Nil for companies with authorised capital up to Rs.15 lakhs; beyond that, MCA charges apply as per the Companies (Registration of Offices and Fees) Rules, 2014.

Stamp Duty on eMoA and eAoA: Varies by state and capital amount (e.g., higher in Maharashtra, lower in Delhi).

PAN and TAN Fee: Rs.131 (including GST), charged by NSDL and collected via SPICe+ form.

Name Reservation Fee (SPICe+ Part A): Rs.1,000 per application.

All payments are made online through the MCA portal and must be completed before final submission of the incorporation forms. An official Challan and SRN (Service Request Number) are generated as acknowledgment of payment and must be retained for future reference.

At Compliance Calendar LLP, we simplify the entire incorporation process with legal precision, professional guidance, and end-to-end documentation support. From name reservation to post-incorporation filings, our experts ensure a seamless experience tailored to your business needs.

Ready to start your Private Limited Company?

Call us at +91-9988424211

Email: info@ccoffice.in Or

Visit us at: www.compliancecalendar.in

Frequently Asked Questions (FAQs)

Q1. What is the minimum requirement to start a Private Limited Company in India?

Ans. As per the Companies Act, 2013, at least two directors, two shareholders, and a registered office address are required. One of the directors must be a resident of India, and all directors must possess a valid Class 3 Digital Signature Certificate (DSC)

Q2. Is physical presence required to register a company in India?

Ans. The entire registration process is online through the MCA V3 portal. All documents and forms are digitally signed and filed electronically, making incorporation location-independent.

Q3. Can a salaried individual or government employee become a director in a private company?

Ans. Salaried individuals can become directors unless their employment contract restricts it. Government employees must obtain prior approval from their department and comply with applicable service conduct rules.

Q4. Can NRIs or foreign nationals incorporate a Private Limited Company in India?

Ans. Foreign nationals and NRIs can be shareholders or directors, subject to the Foreign Exchange Management Act (FEMA) and sectoral regulations. At least one resident Indian director is mandatory.

Q5. Is it mandatory to have a commercial space for the registered office?

Ans. A residential address can be used as the registered office, provided a valid No Objection Certificate (NOC) from the property owner and proof of address (like an electricity or water bill) is submitted.

Q6. How long does it take to register a Private Limited Company in India?

Ans. Generally, the incorporation is completed within 7–10 working days, subject to name approval, document accuracy, and timely verification by the Central Registration Centre (CRC) under MCA

Q7. What is the cost involved in company registration?

Ans. Government fees depend on the authorised capital and state-wise stamp duty. Apart from that, professional fees, DSC charges, and PAN/TAN fees apply. At Compliance Calendar LLP, we provide transparent packages with no hidden charges.

Q8. What is Form INC-20A and when is it required?

Ans. Form INC-20A is a declaration of commencement of business under Section 10A of the Companies Act, 2013. It must be filed within 180 days of incorporation, confirming that the subscribed share capital has been received.

Q9. Can I use the same office address for more than one company?

Ans. Multiple companies can be registered at the same address, provided proper documentary support and NOC from the owner is available for each entity.

Q10. Is GST registration mandatory after company incorporation?

Ans. GST registration is not mandatory unless your company’s aggregate turnover exceeds the threshold limit (Rs.20 lakh or Rs.40 lakh depending on the state and type of supply) or if you're engaged in inter-state supply. However, you may opt for GST voluntarily through the AGILE-PRO-S form at the time of incorporation.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-Form_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_for_Foreign_Directors_learn_crop10_thumb.jpeg)

_Act,_2015_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)