A sole proprietorship is the simplest and most common form of business structure in India, owned, managed, and controlled by a single individual. It is widely chosen by small traders, local shop owners, and micro-businesses due to its ease of setup, flexibility, and minimal compliance requirements. In this form of business, the proprietor enjoys complete control over operations, profits, and decision-making, but also bears unlimited liability for debts and losses.

Unlike other business entities, a sole proprietorship is not considered a separate legal entity, meaning the business and the owner are treated as one. While there is no specific law governing sole proprietorships in India, it is still essential to obtain necessary registrations such as GST, Shop and Establishment Registration, or any industry-specific permits to ensure legal recognition and smooth functioning. Its low cost of establishment, tax benefits, and straightforward management make it an ideal structure for entrepreneurs who wish to start their business with limited investment and full ownership.

What is Sole Proprietorship?

A sole proprietorship is an unregistered business entity that is owned, managed, and controlled by a single individual. It is the simplest form of business structure where there is no legal distinction between the owner and the business, meaning the proprietor bears full responsibility for profits, losses, debts, and liabilities. Unlike companies or partnerships, a sole proprietorship does not require incorporation under the Ministry of Corporate Affairs (MCA), though licenses such as GST registration or a Shop and Establishment License may be required depending on the nature of the business.

Who Can Choose Sole Proprietorship?

A sole proprietorship is an ideal choice for individuals who want to begin their entrepreneurial journey with low capital investment and minimal formalities. It is particularly suitable for small traders, shopkeepers, service providers, and freelancers who wish to operate independently. The setup process is relatively quick and hassle-free, usually taking about 10–15 days, depending on the required licenses and registrations. Another major advantage is that the entire control of the business remains in the hands of the owner, allowing them to take all decisions without interference. This flexibility and autonomy make it a preferred business form for beginners or those running businesses at a local or small scale.

Who is a Sole Proprietor?

A sole proprietor is an individual who exclusively owns, manages, and runs a proprietorship firm. This person has complete authority over the business operations and decision-making. However, with this authority also comes complete responsibility the proprietor is personally liable for all assets, debts, profits, and losses of the business. Unlike in a company or partnership, the business and the individual are not separate legal entities, meaning the proprietor’s personal assets may also be at risk in case of liabilities. Despite this, many people opt for this structure due to its simplicity, ease of management, and cost-effectiveness.

Eligibility Criteria for Registering a Sole Proprietorship in India

Unlike companies or partnership firms, a sole proprietorship is not recognized as a separate legal entity under Indian law. Therefore, there is no specific statute prescribing rigid eligibility conditions for its registration. However, certain requirements must be fulfilled to lawfully establish and operate a proprietorship firm in India. These include:

-

Status as an Indian Citizen and Taxpayer: The proprietor must be a tax-paying citizen of India and is required to comply with all applicable tax laws. All income earned through the business will be taxed in the hands of the proprietor as individual income.

-

Registration under Relevant Laws: While sole proprietorships are not incorporated under the Ministry of Corporate Affairs, they may need to register under the Shops and Establishment Act of the respective State/UT, depending on the nature and location of business activities.

-

GST Registration: Obtaining a Goods and Services Tax (GST) registration becomes mandatory if the firm is engaged in inter-state supply of goods/services or if its annual turnover exceeds the prescribed threshold limit (generally INR 20 lakhs, INR 40 lakhs for goods in some cases).

-

Business Bank Account: A separate current account in the name of the proprietorship firm must be opened for conducting financial transactions. This helps maintain financial transparency and ensures clear distinction between personal and business income.

-

MSME/Udyam Registration: For small businesses, voluntary registration under the MSME Act (now Udyam Registration) is recommended, as it provides access to various government benefits, subsidies, and credit facilities.

-

Mandatory Registrations as per Business Needs: Depending on the nature of business, additional registrations such as ESIC (Employees’ State Insurance Corporation) or EPFO (Employees’ Provident Fund Organisation) may be required if employees are hired.

-

Business Name and Legality: The proposed business name must be unique, non-deceptive, and compliant with Indian laws and regulations. The business activity must not be illegal or prohibited under Indian legislation.

Documents Required for Sole Proprietorship Registration in India

Identity Proof of Proprietor

The proprietor must provide valid identity documents to establish his or her legal recognition as the owner of the business. A self-attested copy of the PAN Card is mandatory for taxation and compliance purposes, as all business income is assessed in the proprietor’s name. Additionally, a self-attested copy of the Aadhaar Card serves as proof of identity as well as address, making it essential for linking other registrations such as GST and MSME. A recent passport-size photograph of the proprietor is also required for most registration applications.

Registered Office Address Proof

Proof of the business premises is required to establish the official address of the proprietorship firm. If the property is self-owned, a sale deed or ownership document along with a utility bill (such as an electricity or water bill) is sufficient. In case the premises are rented, a copy of the rental agreement along with a No Objection Certificate (NOC) from the landlord is mandatory. Utility bills, whether for owned or rented property, act as supporting evidence to verify the actual place of business operations.

Business Bank Account

A sole proprietorship must open a current account in the firm’s name to conduct financial transactions and maintain a clear distinction between personal and business dealings. To open this account, banks generally require the proprietor’s PAN Card, Aadhaar Card, and proof of the business name (such as MSME/Udyam certificate, Shop and Establishment license, or GST certificate). Proof of the office address, such as a utility bill or rental agreement, is also necessary. In some cases, banks may ask for an Income Tax Return (ITR) filed by the proprietor as evidence of business activity.

Registrations and Licenses (as applicable)

Depending on the business model, turnover, and geographical location, certain statutory registrations and licenses may be required in addition to basic identity proofs. MSME/Udyam registration is optional but recommended as it offers government benefits, subsidies, and easier access to loans. GST registration is mandatory if the annual turnover crosses the prescribed threshold (generally Rs.20 lakhs for services and Rs.40 lakhs for goods) or in case of inter-state supply. Businesses operating under the jurisdiction of State laws may need a Shops and Establishment Act license, while specific trades may require a trade license or professional tax registration. Further, if employees are engaged, registrations under ESIC (Employees’ State Insurance Corporation) and EPFO (Employees’ Provident Fund Organisation) may also be necessary.

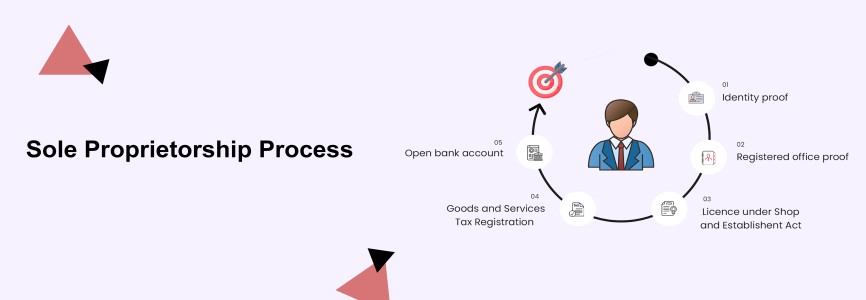

Process to Register a Sole Proprietorship in India

Unlike companies and partnerships, a sole proprietorship does not have a formal incorporation process under the Ministry of Corporate Affairs (MCA). However, to establish the firm and carry out business operations legally, the proprietor must follow certain essential steps and obtain the required registrations. The step-by-step process is as follows:

Step 1: Select a Unique Business Name

The first step is to decide on a suitable and unique name for the proprietorship firm. The chosen name should not infringe upon any registered trademark or violate intellectual property rights. It is advisable to conduct a trademark search on the IP India portal to ensure availability. For stronger protection, proprietors may also consider registering the name or logo as a trademark.

Step 2: Obtain PAN and Aadhaar Card

A Permanent Account Number (PAN) and Aadhaar card of the proprietor are mandatory for all future registrations and compliance requirements. Since a sole proprietorship is not a separate legal entity, the business transactions and tax filings are directly linked with the proprietor’s PAN.

Step 3: Open a Business Bank Account

A separate current account in the name of the proprietorship firm must be opened for conducting financial transactions. This not only ensures transparency between personal and business finances but also reflects professionalism. Banks generally require PAN, Aadhaar, proof of business name (such as MSME or GST certificate), and proof of office address to open the account.

Step 4: Apply for Business Registrations

Depending on the nature and scale of business operations, the following registrations may be obtained:

-

Shops and Establishment Act Registration: Mandatory in most states for businesses operating from a physical office, shop, or establishment.

-

GST Registration: Required if the annual turnover exceeds Rs.20 lakhs (Rs.40 lakhs for goods in certain cases) or in case of inter-state supply of goods or services.

-

MSME/Udyam Registration: Though not compulsory, this registration is highly recommended as it provides access to government schemes, loans, and subsidies.

-

Trade License/Professional Tax Registration: May be required depending on the type of business activity and state regulations.

-

Other Licenses: Industry-specific approvals (like FSSAI license for food businesses) must be obtained where applicable.

Step 5: Obtain Tax Registrations

Apart from GST, sole proprietors may also be required to register under Professional Tax (in certain states) or obtain other tax-related registrations, depending on the nature of business. The proprietor must also ensure timely filing of Income Tax Returns (ITR), as business profits are taxed as individual income.

Step 6: Maintain Business Records

Although compliance requirements are minimal compared to companies, maintaining proper books of accounts, invoices, tax records, and licenses is important. This not only ensures smooth business operations but also helps in audits, loan applications, and future expansions.

Final Thoughts

A sole proprietorship is one of the most convenient and cost-effective ways to start a business in India, especially for individuals who prefer full ownership and independence. Though it lacks the separate legal identity of a company, with the right registrations and licenses, it can operate smoothly and gain credibility in the market. Its ease of setup, low compliance burden, and flexibility make it a popular choice for small-scale entrepreneurs, freelancers, and local business owners. However, since the proprietor bears unlimited liability, careful financial planning and compliance with tax obligations are essential. With proper management, a sole proprietorship can be the perfect foundation for scaling into a larger business entity in the future.

Frequently Asked Questions (FAQs)

Q1. What is a sole proprietorship?

Ans. A sole proprietorship is a business owned and managed by a single individual who is responsible for all profits, losses, assets, and liabilities of the business.

Q2. Is it mandatory to register a sole proprietorship in India?

Ans. No, a sole proprietorship does not require mandatory registration. However, obtaining basic licenses such as GST registration, Shop & Establishment registration, or MSME registration is essential depending on the nature and scale of the business.

Q3. How long does it take to register a sole proprietorship?

Ans. The process is simple and can be completed within 7–10 working days if all documents are in order.

Q4. Can a sole proprietor open a current bank account in the business name?

Ans. Yes, a sole proprietor can open a business bank account. The bank may require documents such as PAN, Aadhaar, business registration certificates, utility bills, and GST/Shop & Establishment registration.

Q5. What are the main documents required for sole proprietorship registration?

Ans. The basic documents include the proprietor’s PAN card, Aadhaar card, proof of office address, bank account details, rental agreement/NOC (if the office is rented), and relevant licenses like GST or MSME registration.

Q6. What are the advantages of a sole proprietorship?

Ans. Some key advantages include easy formation, low compliance requirements, complete control by the owner, quick decision-making, and cost-effectiveness.

Q7. What are the disadvantages of a sole proprietorship?

Ans. The major limitation is unlimited liability, meaning the proprietor’s personal assets can be used to pay off business debts. Additionally, it may be difficult to raise funds compared to other business structures.

Q8. Is GST registration mandatory for sole proprietorship?

Ans. GST registration is required if the annual turnover exceeds Rs.40 lakhs for goods or Rs.20 lakhs for services, or if the business is involved in inter-state supply of goods/services.

Q9. Can a sole proprietorship be converted into another business structure?

Ans. Yes, a sole proprietorship can later be converted into a Private Limited Company, LLP, or Partnership Firm as the business grows.

Q10. Who can start a sole proprietorship?

Ans. Any Indian citizen with valid identity proof and required documents can start a sole proprietorship. It is most suitable for freelancers, small traders, shop owners, and service providers.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-Form_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_for_Foreign_Directors_learn_crop10_thumb.jpeg)

_Act,_2015_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)