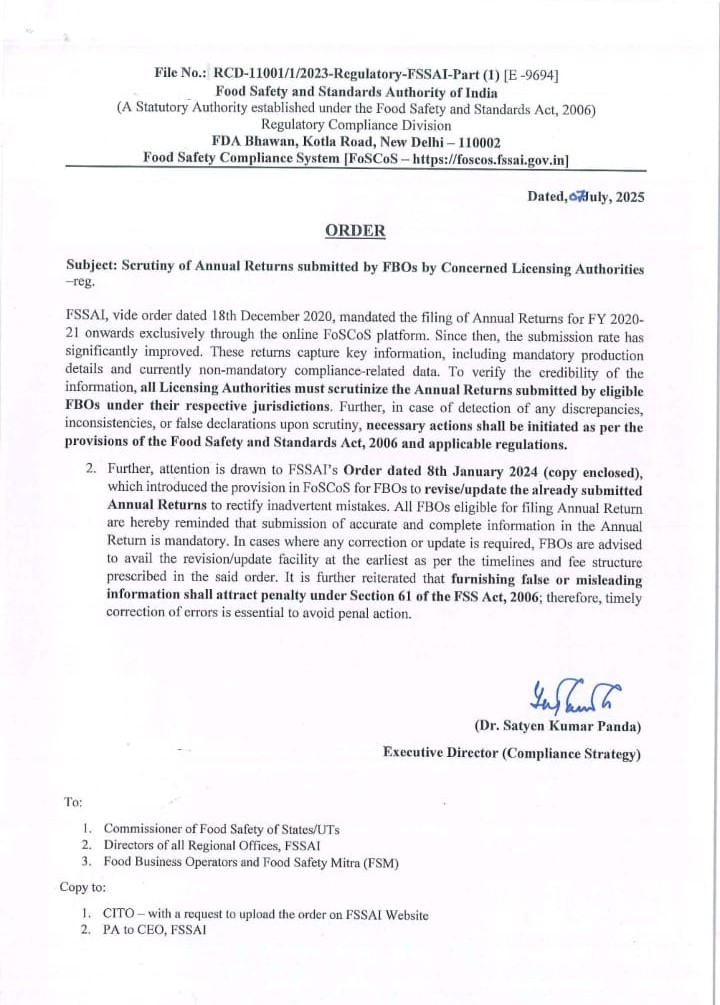

The Food Safety and Standards Authority of India (FSSAI), through its latest order dated July 2025, has reinforced the importance of strict scrutiny of Annual Returns submitted by Food Business Operators (FBOs). The order, issued by the Executive Director (Compliance Strategy), Dr. Satyen Kumar Panda, focuses on enhancing transparency, accuracy, and accountability in food safety compliance across the country. This initiative aims to ensure that the Annual Returns submitted by FBOs reflect correct and complete information as mandated under the Food Safety and Standards Act, 2006.

This article provides a detailed explanation of the July 2025 FSSAI notification, its background, key provisions, and implications for FBOs and Licensing Authorities.

Background of the Annual Return Mandate

On 18th December 2020, FSSAI had issued an order making it mandatory for Food Business Operators (FBOs) to file their Annual Returns for FY 2020–21 and onward exclusively through the online FoSCoS (Food Safety Compliance System) platform. The move was aimed at digitalizing compliance processes and increasing transparency in food business operations. Since its implementation, FoSCoS has recorded a considerable improvement in submission rates and has helped capture vital data, including production details and compliance status of food businesses.

This digital platform enables the collection of both mandatory production data and currently non-mandatory compliance-related information. The goal is to build a robust food safety framework based on reliable data directly provided by FBOs.

Scrutiny of Annual Returns by Licensing Authorities

According to the July 2025 order, all Licensing Authorities must scrutinize the Annual Returns submitted by eligible FBOs under their respective jurisdictions. This scrutiny is essential to ensure the accuracy and reliability of the information submitted via the FoSCoS platform.

Licensing Authorities are directed to check the details carefully for any inconsistencies, discrepancies, or false declarations. If such issues are detected, necessary actions must be taken in line with the Food Safety and Standards Act, 2006, and other applicable regulations. This includes imposing penalties and initiating legal action where appropriate.

This direction emphasizes the role of Licensing Authorities in maintaining regulatory compliance and ensuring that all FBOs are operating within the legal framework of food safety norms.

Revision and Updating of Annual Returns

The latest order also draws attention to a previous directive issued by FSSAI on 8th January 2024, which allows FBOs to revise or update their already submitted Annual Returns. This provision is crucial for enabling FBOs to correct any inadvertent mistakes in their filings.

FSSAI has mandated that the submission of accurate and complete information in Annual Returns is not optional but mandatory. Therefore, in the event of any identified errors, FBOs are advised to avail themselves of the revision/update facility available on FoSCoS as soon as possible. The order also specifies that these corrections should follow the timelines and fee structures as prescribed in the January 2024 order.

Failure to update inaccurate Annual Returns may lead to penalties, further stressing the importance of timely and precise compliance.

Penalty for False or Misleading Information

A major highlight of this order is the reiteration that furnishing false or misleading information in Annual Returns will attract penalties under Section 61 of the Food Safety and Standards Act, 2006. This section provides for penalties in case of false information or failure to comply with directions issued by FSSAI.

This strong message serves as a warning to FBOs to avoid deliberate misreporting and ensure that their submissions reflect their actual business practices and data. The ultimate goal is to build a system based on integrity, compliance, and food safety awareness.

Responsibilities of Food Business Operators

FBOs eligible for Annual Return filing are reminded that the responsibility for submitting accurate and complete data rests solely on them. As per FSSAI’s direction:

-

Filing incomplete or incorrect Annual Returns will not be tolerated.

-

Correction or update of the filed return must be done at the earliest through FoSCoS.

-

FBOs must stay informed about updates in compliance rules and reporting requirements.

-

Delays or failures in rectification may lead to penalties and reputational damage.

This proactive compliance approach aligns with FSSAI’s long-term vision of streamlining food safety practices across the country.

Implementation and Communication Flow

The order has been addressed to:

-

Commissioner of Food Safety of States/UTs.

-

Directors of all Regional Offices of FSSAI.

-

Food Business Operators and Food Safety Mitras (FSMs).

A copy of the order has also been sent to the Chief Information Technology Officer (CITO) for uploading it on the FSSAI website, and to the PA of the CEO, FSSAI.

The intention is to ensure uniform dissemination and implementation of the order across all concerned authorities and stakeholders.

Importance of FoSCoS in Streamlining Annual Return Filing

The Food Safety Compliance System (FoSCoS) has been instrumental in enhancing transparency and ease of compliance for food businesses. It provides a single-window online platform for:

-

Filing Annual Returns

-

Licensing and registration

-

Monitoring compliance status

-

Submitting updates and revisions

The transition to a digital model has brought accountability and reduced paperwork, improving operational efficiency for both regulators and businesses.

Legal Foundation: Section 61 of the FSS Act, 2006

Section 61 of the Food Safety and Standards Act, 2006 empowers FSSAI to impose penalties for furnishing false information or non-compliance with regulatory directions. Penalties under this section may include:

-

Fines up to INR 2 lakhs

-

Suspension or cancellation of license

-

Legal proceedings in case of willful non-compliance

This legal provision serves as the backbone of FSSAI’s enforcement strategy and underscores the seriousness of compliance obligations.

Role of Food Safety Mitras

Food Safety Mitras (FSMs) act as facilitators between FBOs and the regulatory authorities. They assist in:

-

Filing applications and returns on FoSCoS

-

Clarifying compliance requirements

-

Helping small and medium food businesses understand legal obligations

FSMs play an essential role in ensuring that the grassroots-level FBOs, including street vendors and small eateries, do not lag in compliance due to lack of awareness or digital literacy.

Benefits of Annual Return Scrutiny

Key Benefits of Scrutinizing Annual Returns Filed by FBOs for Strengthening Compliance and Ensuring Food Safety Standards are:

Improved Data Accuracy

It’s means that the information provided in annual returns by Food Business Operators (FBOs) is now more reliable and error-free. With FSSAI scrutinizing these returns, inconsistencies or incorrect reporting can be identified early, ensuring better compliance, accurate food safety data, and more informed regulatory decisions.

Enhanced Food Safety Monitoring

It’s refers to FSSAI's increased oversight through scrutiny of annual returns filed by FBOs. This helps identify potential risks, non-compliance, and unsafe practices in the food supply chain. It enables timely corrective action, ensuring safer food for consumers and strengthening the overall food regulatory framework.

Accountability of FBOs

Accountability of FBOs ensures that Food Business Operators are held answerable for their actions and data submissions. With FSSAI's scrutiny of annual returns, FBOs must follow regulations diligently, submit accurate information, and maintain transparency. This strengthens regulatory enforcement and builds a culture of responsibility within the food business ecosystem.

Transparency in Food Supply Chains

That all activities related to food sourcing, processing, and distribution are openly reported and traceable. With FSSAI’s scrutiny of annual returns, Food Business Operators are required to provide clear, accurate information, helping regulators monitor operations, reduce fraud, and maintain high food safety standards.

Regulatory Action Against Violators

Food Business Operators failing to comply with FSSAI norms or providing false or incomplete data in their annual returns may face penalties. This includes license suspension, cancellation, or legal proceedings. Such actions ensure stricter enforcement of food safety standards and deter non-compliant behaviour in the industry.

Conclusion

FSSAI’s July 2025 order is a clear step toward strengthening food safety compliance in India. By mandating Licensing Authorities to scrutinize Annual Returns and enabling FBOs to update their filings, the authority ensures that the food industry operates transparently and responsibly. For FBOs, the message is loud and clear compliance is not optional, and timely, accurate reporting is non-negotiable.

In the coming years, FSSAI is expected to further refine and enhance digital compliance mechanisms, making India's food regulation system more efficient and trustworthy.

Frequently Asked Questions (FAQs)

Q1. What is the main purpose of FSSAI’s July 2025 order?

Ans. The purpose is to mandate the scrutiny of Annual Returns filed by FBOs by Licensing Authorities to ensure accuracy, detect inconsistencies, and initiate necessary actions as per the Food Safety and Standards Act, 2006.

Q2. Who is responsible for scrutinizing the Annual Returns?

Ans. All Licensing Authorities are responsible for verifying Annual Returns submitted by eligible FBOs within their jurisdictions.

Q3. What should FBOs do if they find errors in submitted Annual Returns?

Ans. FBOs must use the FoSCoS revision/update facility to correct mistakes as early as possible, following the guidelines of the 8th January 2024 order.

Q4. What happens if false or misleading information is submitted?

Ans. False or misleading information attracts penalties under Section 61 of the FSS Act, 2006. This may include monetary fines or legal action.

Q5. Is it mandatory for all FBOs to file Annual Returns?

Ans. Yes, all FBOs eligible under FSSAI regulations are required to file Annual Returns via the FoSCoS portal.

Q6. What is Section 61 of the Food Safety and Standards Act, 2006?

Ans. It is a provision that penalizes FBOs for providing false information or failing to comply with directions from authorities. It allows for fines and legal action.

Q7. What role does FoSCoS play in this process?

Ans. FoSCoS is the online platform for filing and updating Annual Returns, enabling data-driven compliance and reducing manual intervention.

Q8. Can Annual Returns be revised after submission?

Ans. Yes, FBOs can revise/update their Annual Returns through FoSCoS as per the provision introduced in the January 2024 order.

Q9. Who are Food Safety Mitras (FSMs)?

Ans. FSMs are trained individuals who assist FBOs in compliance-related tasks, including filing applications and returns on the FoSCoS platform.

Q10. What are the consequences of non-compliance with this order?

Ans. Non-compliance may lead to penalties, legal proceedings, suspension of licenses, and reputational damage for the food business operator.

_learn_crop6_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-Form_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_for_Foreign_Directors_learn_crop10_thumb.jpeg)

_Act,_2015_learn_crop10_thumb.jpg)