Starting a business in India requires adequate funds, which often come from personal savings or financial support from friends and family, especially when setting up a Private Limited Company or any other business entity. Even after the company is registered, promoters face other expenses such as statutory compliances, auditor fees, working capital requirements, and additional registration charges as per business needs.

To encourage entrepreneurship and strengthen the Indian economy, the Government of India, under the leadership of Prime Minister Narendra Modi, has introduced several schemes aimed at providing financial assistance to budding businesses. One such key initiative is the Mudra Loan Scheme, designed to offer easy access to credit for micro and small enterprises without the burden of complex collateral requirements for avoiding high rate of interest charged by the NBFC in the market.

The Mudra Yojana is a government loan scheme started in April 2015 to help small business owners, shopkeepers, and people who want to start their own work and under this scheme, you can get a loan of up to Rs.10 lakh without giving any property or security to the bank, given through banks, NBFCs, and microfinance institutions. There are three types of loans Shishu (up to Rs.50,000) for new businesses, Kishore (Rs.50,001 to Rs.5 lakh) for growing businesses, and Tarun (Rs.5 lakh to Rs.10 lakh) for bigger expansions and loans have low interest rates, simple rules, and easy repayment options. Mudra Yojana makes it easier for people to start or grow a business, earn more, and create jobs in their community.

Main Objectives of Mudra Yojana

The main objectives of Mudra Yojana are to promote entrepreneurship, provide easy credit, support small businesses, create jobs, and ensure financial inclusion are:

Promote Entrepreneurship Across India

Mudra Yojana encourages individuals, especially from rural and semi-urban areas, to start small businesses. By offering loans without collateral, it helps people turn their skills and ideas into profitable ventures, boosting self-reliance and economic participation.

Provide Easy and Affordable Access to Credit

Many small entrepreneurs struggle to get bank loans due to strict requirements. Mudra Yojana provides up to Rs.10 lakh with minimal paperwork, affordable interest rates, and flexible repayment, ensuring financial support for both new and existing small businesses.

Support the Non-Corporate, Non-Farm Sector

The scheme targets micro and small enterprises in manufacturing, trading, and services that operate outside corporate and agriculture sectors. It supports local vendors, artisans, workshops, and service providers to improve productivity, competitiveness, and long-term sustainability.

Boost Employment Generation

By financing small enterprises to start or expand, Mudra Yojana helps create direct self-employment for owners and indirect jobs for workers. This strengthens local economies, reduces unemployment, and enhances income opportunities in both urban and rural areas.

Encourage Financial Inclusion

Many small entrepreneurs operate outside formal banking. Mudra Yojana connects them to recognized financial institutions, enabling credit history building, access to future loans, and use of modern banking services, thereby integrating them into India’s formal financial network.

Categories of Mudra Loans

The Pradhan Mantri Mudra Yojana (PMMY) offers loans under three categories, designed to meet the needs of businesses at different stages of growth:

Shishu Loan

Shishu loans are meant for very small or newly established businesses that need minimal funding to start operations. With a maximum limit of Rs.50,000, these loans help buy raw materials, basic tools, or small equipment, enabling entrepreneurs to begin their journey.

Kishore Loan

Kishore loans cater to businesses that have already started and require more funds to grow. Ranging from Rs.50,001 to Rs.5 lakh, they are used for buying machinery, expanding inventory, or upgrading facilities to improve production and service capacity.

Tarun Loan

Tarun loans are for well-established businesses aiming for large-scale expansion. With a limit of Rs.5,00,001 to Rs.10 lakh, they support opening new branches, purchasing high-value equipment, or diversifying into new products, ensuring faster business growth and higher revenue potential.

Interest Rates and Repayment Terms

Interest rates for Mudra loans are not fixed by the government but are determined by the lending banks, NBFCs, or microfinance institutions, based on RBI guidelines and the borrower’s profile. Generally, the rates remain affordable compared to other business loans.

-

Shishu Loans: Around 8%–12% per annum

-

Kishore Loans: Around 10%–14% per annum

-

Tarun Loans: Around 11%–16% per annum

Repayment terms are flexible, with tenures ranging from 3 to 5 years, depending on the loan amount and purpose. Many lenders also offer a moratorium period (grace period before EMI starts) to allow businesses to stabilize operations. Prepayment of the loan is generally permitted without heavy penalties, encouraging early closure and reducing interest costs.

Eligibility Criteria for Mudra Yojana

The Pradhan Mantri Mudra Yojana (PMMY) is designed to support small businesses that often struggle to access formal credit. To qualify for a Mudra loan, the applicant must meet the following requirements:

Nature of Business

The business should be engaged in non-farm, non-corporate, income-generating activities. This includes manufacturing, trading, or service sector operations such as shops, workshops, salons, food processing units, and small-scale manufacturing units.

Eligible Applicants

The loan can be availed by individual entrepreneurs, sole proprietorship, partnership firms, Limited Liability Partnerships (LLPs), or small private companies that meet the scheme’s operational guidelines.

Age Criteria

The applicant must be at least 18 years old at the time of application and should not exceed 65 years of age at the time of loan maturity.

Loan Amount Limit

The funding requirement should be up to Rs.10 lakh. The scheme offers three categories Shishu, Kishore, and Tarun based on the stage and scale of the business.

Business Stage

Both new startups and existing small businesses can apply, provided they present a viable business plan or income projection that assures repayment capability.

Sector Exclusion and Inclusion

Loans are not available for agriculture-based farming activities, but they can be used for allied activities such as dairy farming, poultry farming, and fisheries, which are considered part of the non-farm sector.

Creditworthiness

Applicants must meet the credit assessment and repayment capacity standards set by the lender. A good financial record or a strong business plan can improve approval chances.

Sectors Covered Under Pradhan Mantri Mudra Yojana

The Pradhan Mantri Mudra Yojana covers a wide range of non-farm, non-corporate sectors in manufacturing, trading, and services. These sectors are chosen to support small entrepreneurs who form the backbone of India’s informal economy.

Transport Sector

Includes funding for the purchase of small commercial vehicles such as auto-rickshaws, taxis, e-rickshaws, passenger vans, and goods transport vehicles. This helps individuals start or expand transport-related services and earn a steady income.

Community, Social, and Personal Service Activities

Covers small service-oriented businesses like beauty salons, tailoring shops, repair workshops, photocopy shops, and cleaning services. These businesses usually require low investment but generate quick returns.

Food Processing Units

Supports micro-units involved in processing agricultural produce into packaged goods, such as snack manufacturing, spice grinding, fruit and vegetable processing, and dairy-based products. This promotes value addition and rural employment.

Textile and Handloom Sector

Provides funding for small-scale textile and handloom activities, including weaving, stitching, embroidery, and garment manufacturing. This helps artisans and small units preserve traditional crafts while improving productivity.

Agriculture Allied Activities

Although direct farming is excluded, PMMY supports allied non-farm activities like dairy farming, poultry farming, fisheries, and beekeeping. These sectors provide additional income to rural households.

Small Manufacturing Units

Includes units engaged in small-scale production like furniture making, handicrafts, packaging, light engineering, and other manufacturing activities requiring basic machinery or tools.

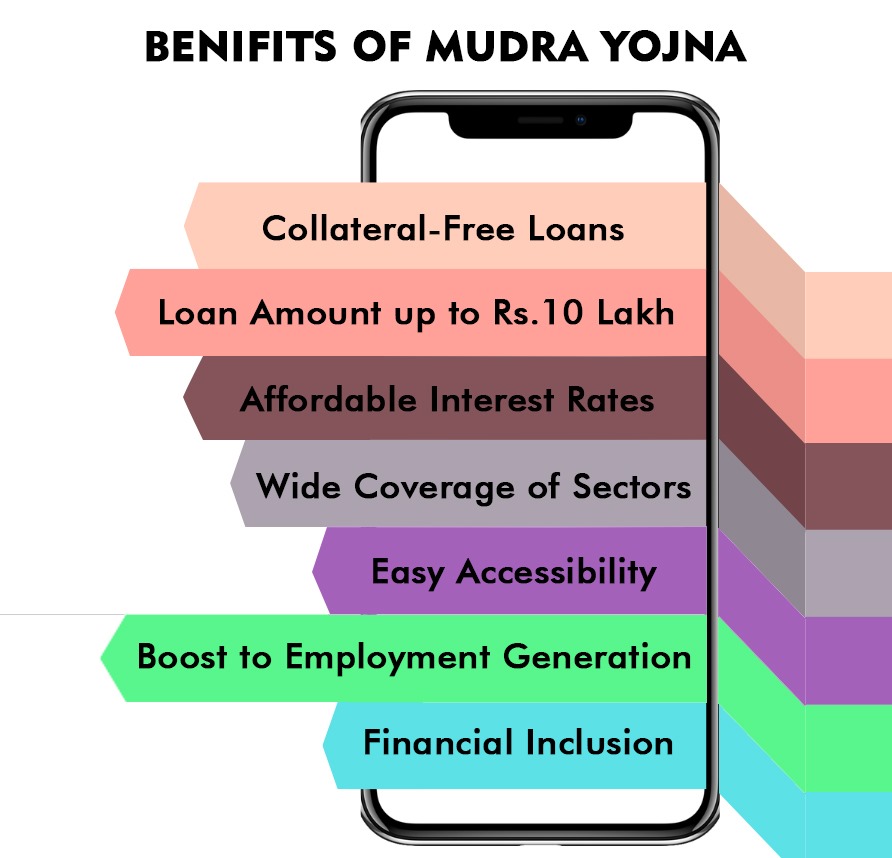

Benefits of Mudra Yojana

The Pradhan Mantri Mudra Yojana (PMMY) offers several advantages to small entrepreneurs, startups, and micro-business owners by making access to credit simpler and more affordable.

Collateral-Free Loans

One of the biggest benefits is that Mudra loans are offered without any collateral or security, makes it easier for small business owners, who often do not own valuable assets, to get funding.

Loan Amount up to Rs.10 Lakh

The scheme provides flexible loan amounts through Shishu, Kishore, and Tarun categories, meeting the needs of businesses at different growth stages from starting a new venture to expanding an existing one.

Affordable Interest Rates

Interest rates are generally lower compared to other business loans, making repayment easier and less burdensome for small entrepreneurs.

Wide Coverage of Sectors

The scheme supports a range of activities in manufacturing, trading, and services, including transport, food processing, textiles, and allied agricultural activities like dairy and poultry.

Easy Accessibility

Mudra loans are available through a wide network of banks, NBFCs, MFIs, and regional rural banks, ensuring entrepreneurs can access funds in both urban and rural areas.

Boost to Employment Generation

By supporting small businesses, the scheme indirectly creates job opportunities and encourages self-employment, strengthening the local economy.

Financial Inclusion

It brings unbanked and underbanked individuals into the formal financial system, improving their credit history and making it easier to access future loans.

How to Apply for a Mudra Loan

Applying for a Mudra Loan under the Pradhan Mantri Mudra Yojana (PMMY) is a straightforward process, but applicants must follow the correct steps and prepare the required documents.

Identify Your Loan Requirement

Decide the amount you need based on your business stage. Shishu loans suit new businesses, Kishore for moderate expansion, and Tarun for large-scale growth. Choosing the right category ensures you borrow exactly what you require.

Choose the Lending Institution

Mudra loans are available from banks, NBFCs, MFIs, RRBs, and Small Finance Banks. Select a lender convenient to your location and with a good service record to make the loan process smoother and faster.

Prepare the Required Documents

Gather identity proof, address proof, business proof, financial statements, and a detailed business plan. Proper documentation builds lender confidence, speeds up verification, and increases the chances of quick loan approval without unnecessary delays.

Fill Out the Application Form

Obtain the Mudra Loan Application Form from your chosen lender or its website. Complete it with accurate details of your personal information, loan requirement, business purpose, and repayment plan to avoid any rejection during verification.

Submit the Application and Documents

Attach the required documents with the filled application form and submit them to the lender. Ensure all details are correct, as incomplete or inaccurate submissions can delay loan processing and disbursement.

Loan Processing and Verification

The lender reviews your application, verifies documents, and evaluates your creditworthiness. They may request additional information or clarification. This stage ensures that your repayment ability and business purpose match the Mudra loan guidelines.

Loan Approval and Disbursement

Once approved, the loan amount is credited to your bank account. Many lenders also issue a Mudra Card a RuPay debit card linked to your loan account to facilitate easy withdrawals and business-related purchases.

The Mudra Card

The Mudra Card is a specially designed RuPay debit card issued to beneficiaries of the Pradhan Mantri Mudra Yojana (PMMY). It is directly linked to the borrower’s Mudra loan account and provides a flexible way to access approved loan funds. Instead of disbursing the full loan amount in one lump sum, the lender credits it to the Mudra Card account, allowing the borrower to withdraw funds as and when needed. This system ensures that the entrepreneur uses the loan judiciously for genuine business purposes, such as purchasing raw materials, paying suppliers, or covering operational costs.

Key Features of the Mudra Card

-

Linked to Loan Account: Works like an overdraft facility, giving access to approved funds directly.

-

Controlled Withdrawals: Borrowers can withdraw only the amount they need at a given time, reducing idle funds.

-

Wide Usability: Accepted across ATMs, Point-of-Sale (POS) terminals, and online payment gateways in India via the RuPay network.

-

Transaction Tracking: Helps maintain transparency in fund usage by recording all transactions digitally.

Benefits of Using the Mudra Card

-

Interest Savings: Interest is charged only on the amount withdrawn, not on the total sanctioned loan.

-

Better Fund Management: Allows phased withdrawals, aligning with the business’s cash flow needs.

-

Ease of Purchase: Can directly pay for machinery, tools, or business supplies without handling large amounts of cash.

-

Improved Credit Discipline: Digital tracking promotes responsible borrowing and repayment habits.

By combining the benefits of a debit card with the flexibility of a loan account, the Mudra Card makes it easier for small entrepreneurs to manage their finances efficiently while keeping borrowing costs in check.

Final Thoughts

The Mudra Yojana is a helpful government scheme for small business owners and people who want to start their own work. It gives loans up to Rs.10 lakh without asking for any property as security. With its three loan types, Shishu, Kishore, and Tarun it supports businesses at different stages, from starting to expanding. The loans come with low interest rates, easy repayment options, and are available through banks, NBFCs, and microfinance institutions. This scheme not only provides money but also creates jobs, supports self-employment, and helps more people join the formal banking system. Whether you need funds to buy equipment, increase stock, or open a new branch, Mudra Yojana ensures you get the financial help you need. It is a simple, practical, and powerful way to grow small businesses and improve local economies.

Frequently Asked Questions (FAQs)

Q1. What is the Pradhan Mantri Mudra Yojana (PMMY)?

Ans. PMMY is a government scheme launched in April 2015 to provide collateral-free loans up to Rs.10 lakh to small and micro businesses in the non-farm, non-corporate sector.

Q2. What are the types of Mudra Loans?

Ans. The loans are classified into three categories: Shishu (up to Rs.50,000), Kishore (Rs.50,001 to Rs.5 lakh), and Tarun (Rs.5 lakh to Rs.10 lakh), based on the stage of the business.

Q3. What is the interest rate for Mudra Loans?

Ans. Interest rates are decided by individual lenders as per RBI guidelines. Generally, they range from 8% to 16% per annum, depending on the loan category and borrower profile which is must lower than the NFC company loan interest rate or other loan interest in the market.

Q4. Who is eligible for a Mudra Loan?

Ans. Individuals, proprietary firms, partnership firms, LLPs, and Private Limited/other registered company which are small companies engaged in manufacturing, trading, or services can apply. Applicants must be between 18–65 years and require funding of up to Rs.10 lakh.

Q5. Are Mudra Loans available for agriculture?

Ans. Direct agriculture-related farming activities are not covered. However, allied activities like dairy farming, poultry, fisheries, and beekeeping are eligible.

Q6. What are the benefits of Mudra Yojana?

Ans. Key benefits include collateral-free loans, flexible loan sizes, affordable interest rates, wide sector coverage, job creation, and financial inclusion.

Q7. How can I apply for a Mudra Loan?

Ans. You can apply through banks, NBFCs, RRBs, MFIs, or Small Finance Banks. Prepare the required documents, fill out the Mudra Loan Application Form, and submit it to your chosen lender for processing.

Q8. What is a Mudra Card?

Ans. A Mudra Card is a RuPay debit card linked to your Mudra loan account. It allows flexible withdrawals, helps track expenses, and ensures funds are used for business purposes.

Q9. Is collateral or security required for a Mudra Loan?

Ans. No, all Mudra loans are collateral-free. You do not need to mortgage property or provide any security to get the loan.

Q10. What is the repayment period for Mudra Loans?

Ans. Repayment tenure generally ranges from 3 to 5 years, with flexible EMI options. Some lenders also offer a moratorium period before EMI payments begin.

Q11. Can women entrepreneurs get special benefits?

Ans. Yes, many banks offer a reduced interest rate for women applicants under Mudra Yojana to promote women entrepreneurship.

Q12. Can Mudra Loan be used for personal expenses?

Ans. No, Mudra loans are strictly for business purposes like buying equipment, increasing stock, or expanding operations.

_crop10_thumb.jpg)

_Rules,_2025_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

in BIS FMCS_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Code C-888_learn_crop10_thumb.jpeg)

_learn_crop10_thumb.jpg)

_Certificate_learn_crop10_thumb.jpg)

_Certificate_(1)_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Scheme_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)