The establishment of an insurance company in India is a regulated process under the Insurance Regulatory and Development Authority of India (IRDAI). The first formal step towards setting up an insurance business is to file Form IRDAI/R1, which serves as a requisition for registration. This form initiates the application process, and its approval is mandatory before one can proceed to the next stage of registration (Form IRDAI/R2).

This article delves into the structure, purpose, and essential components of the IRDAI/R1 Form, along with the based on the IRDAI (Registration of Indian Insurance Companies) Regulations, 2016 (Seventh Amendment).

What is Form IRDAI/R1?

Form IRDAI/R1 is the first application that a company or LLP must submit to the IRDAI to request permission to register as an insurance company registration in India. It is a requisition for the registration application and acts as a gatekeeping form unless IRDAI approves this form, the applicant cannot proceed to the next stage (Form IRDAI/R2).

Essentials Required for Filing Form IRDAI/R1

To be considered valid, the IRDAI/R1 application must be submitted with the following supporting documents:

1. Certificate of Incorporation

What is a Certificate of Incorporation?

A Certificate of Incorporation (COI) is a legal document issued by the Registrar of Companies (RoC), Ministry of Corporate Affairs (MCA), after the successful registration of a company. It grants legal status to the company, allowing it to function as a separate legal entity, distinct from its members or directors.In simpler terms, the COI acts as the birth certificate of the company marking the point at which the company comes into existence in the eyes of the law.

Governing Provision – Section 7 of the Companies Act, 2013

Section 7 of the Companies Act, 2013 governs the incorporation of companies. It lays down the procedure for submitting incorporation documents, Verification by the Registrar, Issuance of the Certificate of Incorporation

Key Highlights of Section 7: The COI is issued only after proper scrutiny of incorporation documents such as MOA, AOA, declarations, affidavits, and identity/address proofs of subscribers. Once the COI is issued, the company is deemed to have been incorporated and has legal personality.

Legal Effect of a Certificate of Incorporation

Once issued, the COI, Acts as conclusive evidence that all requirements of incorporation have been met. Confers the company with juridical personality, a right to own property, sue and be sued, enter into contracts, etc. Provides the company with a perpetual succession, unaffected by changes in membership or death of directors/shareholders. Validates the company’s name and date of incorporation. Permits the company to commence business operations subject to additional compliance under some cases like public limited companies

Procedure for Obtaining a Certificate of Incorporation

The following steps are followed to obtain a COI:

Step 1: Obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN)- DSC is needed for signing e-forms.DIN is a unique number for each director issued by MCA.

Step 2: Apply for Name Reservation

-

Use the SPICe+ Part A form to propose company names.

-

Name approval is subject to availability and naming guidelines under the Companies (Incorporation) Rules, 2014.

Step 3: Prepare MOA and AOA

-

Memorandum of Association (MOA) defines the object and scope of the business.

-

Articles of Association (AOA) define internal rules and governance mechanisms.

Step 4: Filing Forms and Documents

-

SPICe+ Part B is submitted online along with:

-

Declaration by directors and subscribers

-

Proof of registered office

-

PAN/TAN application stamp duty and registration fees must be paid

Step 5: Verification by RoC and Issuance of COI- Upon satisfaction, the RoC issues a digitally signed Certificate of Incorporation and emails it to the company's directors.

Legal Importance and Evidentiary Value

The Certificate of Incorporation holds immense legal value, It is conclusive proof of the company’s existence. It validates the company’s compliance with incorporation provisions.

It Cannot be challenged in court for technical defects once issued. Courts have held in several judgments that even if fraud is later discovered, the COI remains valid unless revoked by a competent authority.

2. Charter Documents

When incorporating a company in India, two fundamental legal documents are essential: the Memorandum of Association (MOA) and the Articles of Association (AOA). These documents form the constitution of the company. While the MOA outlines the company’s objectives and scope of activities in relation to the external world, the AOA governs its internal structure and day-to-day operations. Prepared and submitted to the Registrar of Companies (RoC) at the time of incorporation, the MOA and AOA are legally binding and define the framework within which the company must operate.

Memorandum of Association (MOA)

The Memorandum of Association is regarded as the charter document of a company. It provides the legal identity of the company and defines its relationship with external parties, including shareholders, regulatory authorities, and the general public. It contains the primary details regarding the formation, powers, and scope of business of the company. Importantly, the company cannot undertake any activities beyond those specified in the MOA, following the principle of ultra vires, making this document a cornerstone of legal compliance.

Legal Basis

Under the Companies Act, 2013, Section 4 provides the requirements of the MOA, while Section 7(1)(a) mandates its submission at the time of incorporation. The MOA must be signed by the initial subscribers to the company and is submitted to the Registrar of Companies during registration.

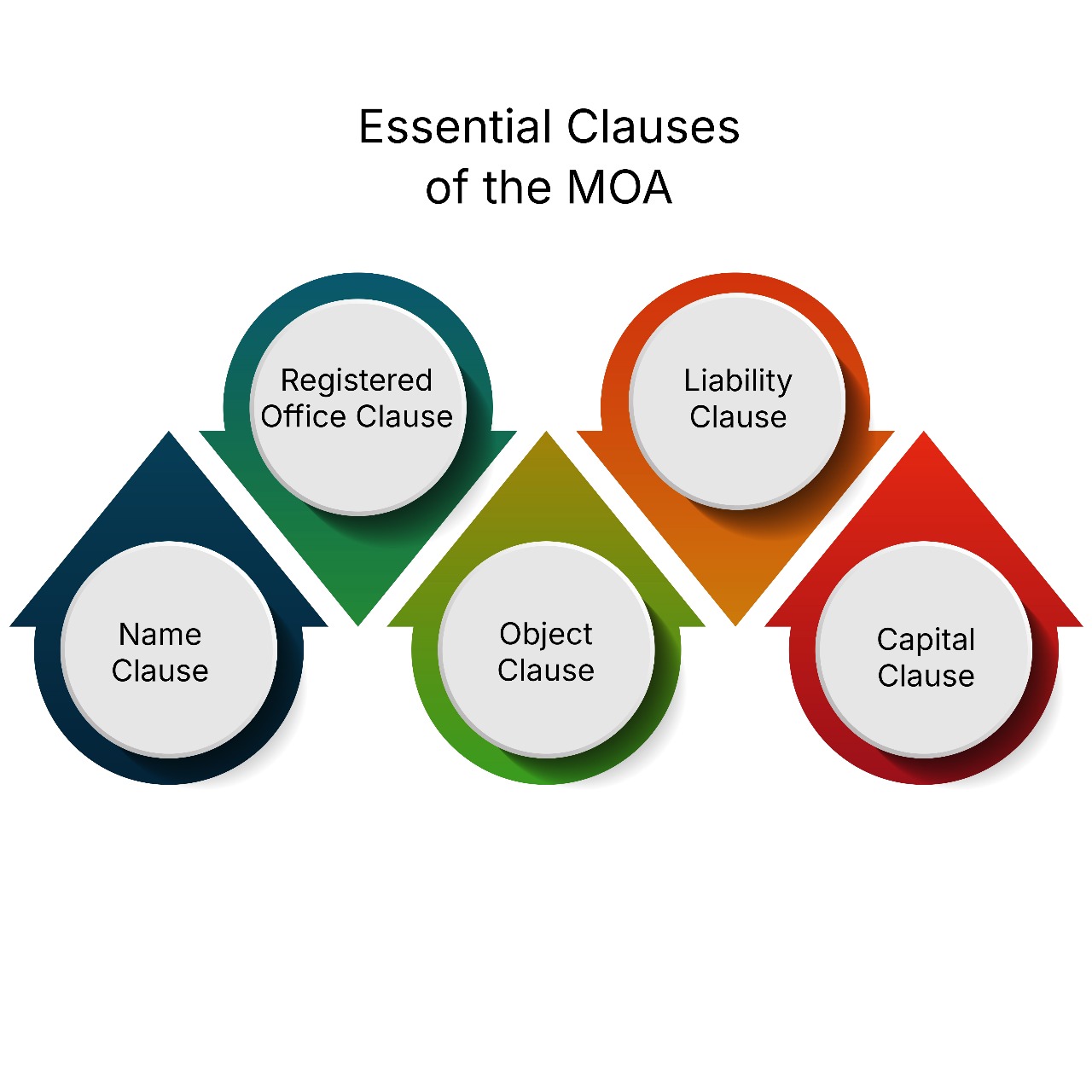

Essential Clauses of the MOA

The MOA must contain the following five mandatory clauses:

1. Name Clause

The name clause specifies the official name of the company. A private company must end its name with "Private Limited", while a public company must end with "Limited". The chosen name must not be identical or deceptively similar to any existing registered company and must comply with the naming rules under the Companies Act and relevant trademark laws.

2. Registered Office Clause

This clause states the name of the State or Union Territory in which the company’s registered office is situated. The registered office determines the jurisdiction of the concerned RoC. While the exact address can be provided within 30 days of incorporation, this clause must specify the state during the incorporation process. The registered office is the company’s legal address for receiving notices, communications, and official documents.

3. Object Clause

The object clause defines the purpose for which the company is established and restricts the company’s operations to those listed objectives. This clause is divided into:

-

Main Object: The core business the company will undertake.

-

Incidental or Ancillary Objects: Supplementary activities necessary for achieving the main object.

-

Other Objects: Any additional objectives (applicable under earlier laws, but less relevant under the current Act).

This clause is important as any action outside the scope of the object clause is void and unenforceable.

4. Liability Clause

The liability clause defines the extent of liability of the members. In a company limited by shares, liability is restricted to the unpaid amount on shares held. In a company limited by guarantee, liability is limited to the amount guaranteed by members. In the case of unlimited companies, the liability is unrestricted.

5. Capital Clause

The capital clause specifies the authorised share capital of the company and the division of this capital into shares of fixed denominations. It also indicates the types of shares the company is authorised to issue—such as equity shares or preference shares. This clause forms the basis for issuing shares and raising capital from investors.

Importance of MOA

The MOA serves as a public document and is accessible to stakeholders upon payment of prescribed fees. It allows investors and stakeholders to understand the scope of the company's activities and assess the risk and purpose before associating with the company. Additionally, MOA compliance ensures that the company acts within its legal boundaries, which enhances trust and corporate discipline.

Articles of Association (AOA)

The Articles of Association (AOA) defines the internal management structure of a company. It is a subordinate document to the MOA and contains the rules and regulations governing the company’s operations, including board meetings, appointment of directors, dividend policies, and administrative procedures. While the MOA describes what the company is formed to do, the AOA outlines how it will be done.

Legal Framework

The AOA is governed by Section 5 of the Companies Act, 2013. It must be filed with the RoC during incorporation and can be altered later by passing a special resolution. However, any provisions in the AOA that contradict the MOA or the Companies Act are void to the extent of the inconsistency.

Key Contents of the AOA

The AOA typically includes the following provisions:

1. Share Capital: It outlines the classes of shares, share capital structure, procedures for allotment, call on shares, forfeiture, transfer, and transmission of shares.

2. Appointment and Powers of Directors: The AOA specifies the process for appointment, qualifications, retirement, resignation, and removal of directors, along with their powers, responsibilities, and compensation.

3. Dividends and Reserves: It includes rules for declaration and distribution of dividends, creation of reserves, and utilization of profits.

4. Accounts and Audit: This section defines procedures related to maintenance of books of accounts, periodic audits, and appointment of auditors.

5. Borrowing Powers: AOA defines how and when the company can borrow funds, issue debentures, or mortgage its assets.

6. Meetings and Resolutions: The AOA sets out the rules for conducting Annual General Meetings (AGMs), Extraordinary General Meetings (EGMs), quorum requirements, voting procedures, and circulation of notices.

7. Winding Up: Provisions relating to voluntary or compulsory winding up of the company and the procedure to be followed during dissolution are also included.

8. Other Provisions: These may include lien on shares, notice provisions, use of company seal, common seal, manner of passing resolutions, and shareholder rights in specific situations.

Legal Role of AOA

The AOA functions as a contract between the company and its members, and among the members themselves, as provided under Section 10 of the Companies Act. It regulates internal disputes, board-member responsibilities, and routine corporate governance. Since it is subordinate to the MOA, any provision in conflict with the latter is deemed invalid.

Relationship Between MOA and AOA

The MOA and AOA are interlinked but distinct. The MOA lays down the broad objectives and external limitations of a company, while the AOA provides the rules for internal functioning. The MOA takes precedence over the AOA in the event of a conflict. While the MOA can only be altered under strict legal procedures (especially in the object clause), the AOA can be amended more flexibly by passing a special resolution in a general meeting.

3. Five-Year Business Plan

Starting an insurance company in India requires a solid plan that shows how the company will grow, serve customers, and follow government rules. The Insurance Regulatory and Development Authority of India (IRDAI) requires a detailed 5-year business plan when applying for a license. This plan explains what the company will do, how it will earn money, what insurance products it will sell, and how it will follow the law.

Company Overview: The new company will be set up as a Private Limited Company. It will be promoted by Indian business groups, possibly with foreign investors (as allowed by IRDAI). The company’s head office will be in Mumbai, with branches opening in other cities. The focus will be on life and health insurance in the beginning, with plans to expand to other insurance types later.

Products and Services:The company will offer insurance products such as:

-

Life Insurance (Term plans, savings plans)

-

Health Insurance

-

Group Life or Health Plans for companies

-

Critical Illness and Personal Accident Policies

These products will be affordable and designed for families, individuals, and small businesses. Special care will be taken to make claims easy and fast, and customers will be supported through call centers and digital platforms.

Understanding the Market: India has a huge potential for insurance as many people still don’t have proper coverage. There’s growing awareness about the need for health and life insurance. The company will study customer needs, keep an eye on competitors, and look for opportunities, especially in smaller towns and cities, and among young working professionals.

Sales and Marketing Plan: To sell insurance, the company will:

-

Use a network of trained agents and brokers

-

Sell policies online through its website and app

-

Partner with banks and online shopping sites

-

Use advertisements (TV, social media, etc.) in multiple languages

To keep customers, the company will offer loyalty benefits, reminders for policy renewals, and strong customer support.

Operations Plan: The company will build:

-

A central office to handle policies, claims, and queries

-

An online system for customers to buy and manage their policies

-

A secure IT setup to protect data and meet privacy rules

-

A team to handle underwriting (risk checking) and claims

Processes will be made simple, fast, and customer-friendly.

Financial Plan: Initial Funding: The company needs at least Rs.100 crore capital, as required by IRDAI.

Revenue & Profit Forecast:

-

Year 1–2: Focus on setup and growth. Some loss expected.

-

Year 3: Aim to break even (no profit, no loss).

-

Year 4–5: Expect profits from renewals and growth.

Financial statements like income reports, balance sheets, and cash flows will be prepared every year to track progress and stability.

Management Team: The company will be led by:

-

A CEO (Chief Executive Officer)

-

Experts in finance, insurance, law, and technology

-

A Board of Directors to make important decisions

These people will have strong experience in insurance and business management.

Risk Management: Insurance companies must deal with many risks. To handle them, the company will:

-

Carefully check customers before giving insurance

-

Use reinsurance (sharing risk with other companies)

-

Keep strong safety plans in case of emergencies

-

Follow legal and financial rules strictly

Legal and Regulatory Compliance: The company must follow all IRDAI rules. This includes:

-

Filing forms like IRDAI/R1 and R2

-

Keeping minimum capital of Rs.100 crore

-

Ensuring foreign investment is within allowed limits

-

Submitting regular reports to IRDAI

-

Protecting customer data as per law

A compliance officer will be appointed to handle legal matters.

4. Details of Directors

When applying for an insurance company license from the Insurance Regulatory and Development Authority of India (IRDAI), one of the most important components is providing complete and verifiable details of all directors involved in the company.

This is because the IRDAI places great emphasis on the professionalism, reputation, and competence of those who will be in charge of running the insurance business.

5. Annual Reports

When an applicant applies for an insurance company license from the Insurance Regulatory and Development Authority of India (IRDAI), it must submit the audited annual reports of both Indian promoters and foreign investors for the preceding five financial years.

This requirement is part of the documentation under Form IRDAI/R1, which is the first step in obtaining approval to set up an insurance company in India.

Who Are Indian Promoters and Foreign Investors?

-

Indian Promoters: Indian companies or individuals with significant ownership and control over the proposed insurance company. They are responsible for initiating and funding the venture in India.

-

Foreign Investors: Any foreign entity (insurance company, investment fund, or corporate group) that is proposing to invest equity in the Indian insurance company, subject to FDI limits (currently 74%).

6. Shareholding Agreement

-

Between Indian promoters and foreign investors

-

Helps IRDAI verify the structure and ownership control

Procedure for Submission and Review

-

Submission of IRDAI/R1 form along with all required documents.

-

IRDAI reviews the application and may request additional information or clarification.

-

If satisfied, IRDAI issues a go-ahead for filing Form IRDAI/R2.

-

If not satisfied, IRDAI may reject the application and provide reasons in writing.

Conclusion

The submission of audited annual reports of Indian promoters and foreign investors for the last five financial years is a important compliance requirement under IRDAI’s insurance company licensing process. These reports provide insight into the financial strength, stability, experience, and credibility of the parties backing the proposed insurance venture. By ensuring complete, accurate, and transparent documentation, the applicant demonstrates its readiness to responsibly enter the insurance business, thereby building confidence with the regulator and laying the foundation for long-term regulatory compliance and business success.

Frequently Asked Questions (FAQs)

Q1. Why does IRDAI ask for five years of annual reports from promoters and investors?

Ans. IRDAI requires this to assess the financial stability, track record, and regulatory integrity of the promoters and foreign investors. It helps determine if they are capable of funding and sustaining an insurance company in the long term.

Q2. Do these annual reports need to be audited?

Ans. Yes. All submitted reports must be audited by a registered Chartered Accountant (CA) or an equivalent authority in the promoter’s or investor’s country of origin.

Q3. What if the foreign investor's reports are in another language?

Ans. In that case, the reports must be accompanied by certified English translations. This ensures IRDAI can properly assess and review the documents.

Q4. What financial details are reviewed in these reports?

Ans. IRDAI looks into:

-

Net worth

-

Profit and loss history

-

Debt levels

-

Cash flow

-

Auditor's remarks

-

Compliance with other regulatory bodies

Q5. Can a promoter be disqualified based on poor financial history?

Ans. Yes. If the annual reports show consistent losses, debt default, regulatory violations, or a lack of financial capability, IRDAI may reject the application or request additional clarification or assurances.

Q6. Are these reports made public?

Ans. No. These reports are submitted to IRDAI for internal review and are not made publicly available, unless required by law or court order.

Q7. What happens if one year’s report is missing or incomplete?

Ans. Incomplete submission may lead to delays or rejection of the application. It’s important to provide all five years’ reports in full, along with any supporting documents.

Q8. Are startups eligible if they don’t have five years of financial history?

Ans. Startups or new entities must disclose this fact and may submit alternate financial credentials or rely on the track record of the parent company or group promoters.

Q9. What is the difference between a promoter and a foreign investor?

Ans. A promoter is someone who initiates and drives the formation of the company typically Indian. A foreign investor is an external, overseas entity providing capital or strategic support. Both need to show their financial track record.

Q10. Can IRDAI request more financial documents in addition to annual reports?

Ans. Yes.IRDAI may seek clarifications, interim financial statements, or supporting documents if they need more information during the review process.

_crop10_thumb.jpg)

_Rules,_2025_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

in BIS FMCS_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Code C-888_learn_crop10_thumb.jpeg)

_learn_crop10_thumb.jpg)

_Certificate_learn_crop10_thumb.jpg)

_Certificate_(1)_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Scheme_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)