GSTR-2B is a static auto-drafted statement that provides a month-wise summary of Input Tax Credit (ITC) available and not available for a registered GST taxpayer. Introduced by the Goods and Services Tax Network (GSTN), it helps businesses reconcile their purchase data with the suppliers’ data filed in GSTR-1, GSTR-5, and GSTR-6. GSTR-2B was launched starting from the August 2020 tax period and is available for all regular taxpayers, including SEZ units and casual taxpayers. Unlike GSTR-2A, which is a dynamic form and updates in real-time as suppliers upload invoices, GSTR-2B remains unchanged once generated for a specific period. This helps in better planning and accurate reconciliation of Input Tax Credit (ITC).

Recent Updates from Union Budget 2025

The Union Budget 2025 proposed an amendment in Section 38(1) of the CGST Act, 2017. The word "autogenerated" has been removed, which means that the GSTR-2B may not be entirely system-generated going forward. Businesses may need to validate invoices through the Invoice Management System (IMS) rather than relying only on auto-generated data. This change will be effective once the relevant notification is issued.

Importance and Benefits of GSTR-2B

GSTR-2B plays an important role in easing the process of claiming accurate ITC. It provides document-wise information of inward supplies, highlighting ITC eligibility and ineligibility. This helps in reconciling purchase records with the GST returns filed by the suppliers. The benefits include:

-

Prevents double claiming of ITC on the same invoice.

-

Helps in timely reversal of ITC where applicable under GST law.

-

Aids in correct payment of GST under reverse charge mechanism (RCM).

-

Specifies the exact table and section of GSTR-3B where the ITC should be claimed.

The availability of GSTR-2B in a downloadable and viewable format makes it easier for businesses to integrate the data into their accounting systems and ensure compliance.

When is GSTR-2B Generated?

GSTR-2B is generated every month on the 14th of the succeeding month. For instance, the GSTR-2B for March 2025 will include documents filed by suppliers between 14th March 2025 and 13th April 2025. This ensures that businesses have enough time to reconcile their ITC before filing GSTR-3B. From August 2020 to December 2020, it was generated on the 12th of the next month. However, from January 2021 onwards, the date was changed to the 14th of the succeeding month.

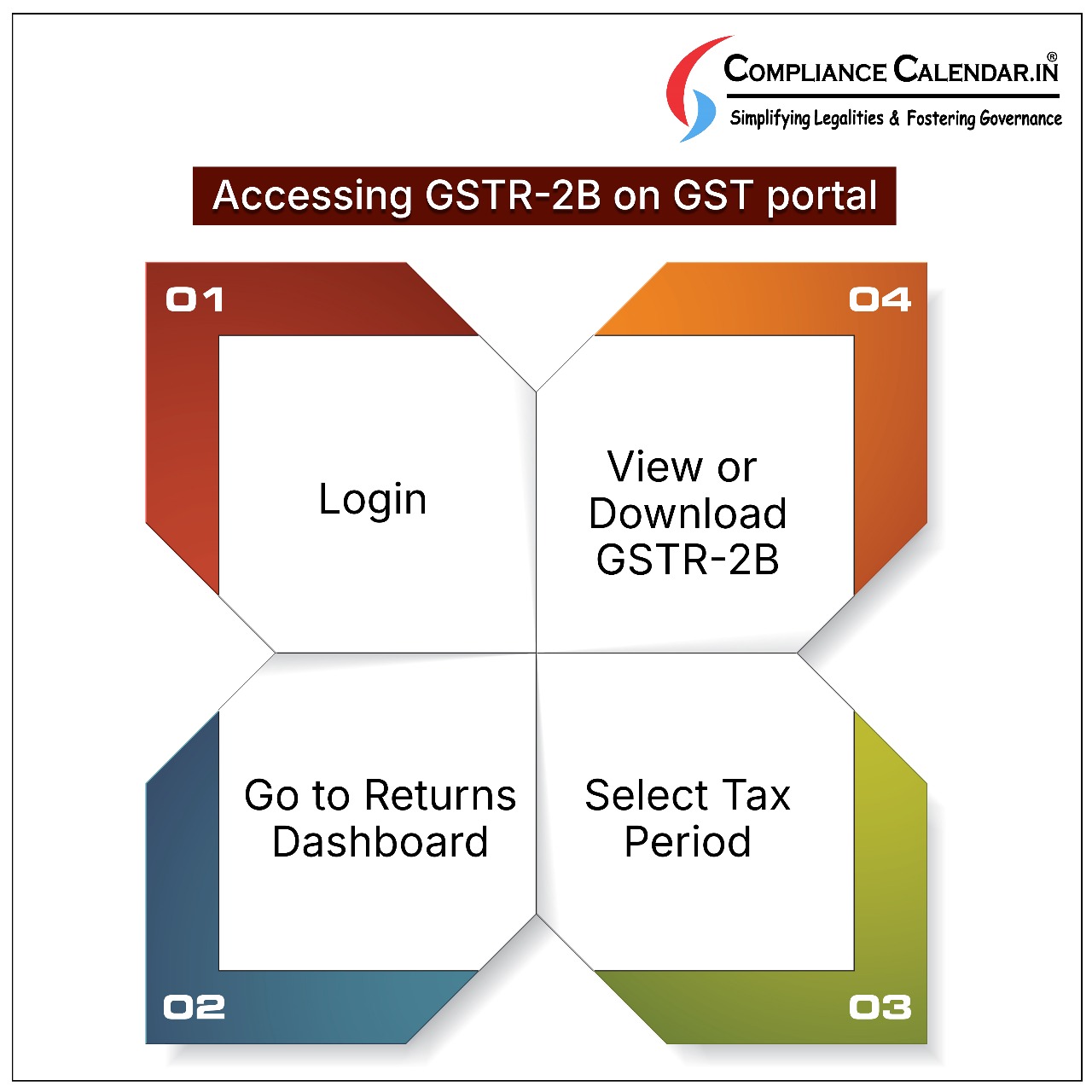

How to Access GSTR-2B on GST Portal?

Accessing GSTR-2B is simple and can be done through the GST portal:

Login

Visit the official GST portal at www.gst.gov.in and log in using your valid username and password. Only registered GST users can access the GSTR-2B form. Ensure that the user credentials are active and correct to proceed further.

Go to Returns Dashboard

After logging in, go to the ‘Returns Dashboard’ option available on the main page. This section provides access to all return-related forms and documents for different tax periods. It’s the central location for managing GST filings.

Select Tax Period

Choose the appropriate financial year and month for which you want to view the GSTR-2B. This ensures that the system fetches the relevant month’s auto-drafted ITC statement. Double-check the selected period to avoid viewing the wrong data.

View or Download GSTR-2B

On the GSTR-2B tile, click ‘View’ if the number of documents is under 1,000—this allows on-screen review. For larger datasets (above 1,000 documents), click ‘Download’ to get a consolidated offline version. This option helps in detailed reconciliation and offline analysis.

Contents and Features of GSTR-2B

GSTR-2B is divided into two main sections:

1. ITC Available (Part A and B):

-

Part A contains invoice-wise details of ITC available from regular taxable persons, ISD, RCM, and import of goods.

-

Part B highlights the ITC to be reversed under various heads as per the GST laws.

2. ITC Not Available (Part A and B):

-

Part A includes documents for which ITC cannot be availed due to non-compliance with the law.

-

Part B contains details of ineligible credit on account of wrong place of supply or supplier-recipient mismatch.

Document Types Reflected in GSTR-2B

The statement includes various types of documents such as:

-

B2B Invoices

-

Credit and Debit Notes

-

ISD Invoices

-

Amendments to previously filed documents

-

Import of Goods (from customs)

These are all displayed in a document-wise format, allowing easy sorting and filtering. It includes details like GSTIN, invoice number, date, taxable value, and tax amounts (IGST, CGST, SGST, CESS).

Scenarios Where ITC is Marked as 'Not Available'

The ITC in GSTR-2B is shown as ‘Not Available’ in the following cases:

-

The time limit to avail ITC has expired under Section 16(4) of the CGST Act.

-

Place of supply and supplier’s state are the same, while the buyer is in another state, making it an ineligible inter-state supply.

-

Ineligible credit under GST law for specific types of purchases.

Comparison Between GSTR-2A and GSTR-2B

While both GSTR-2A and GSTR-2B help in ITC reconciliation, there are major differences:

-

GSTR-2A is dynamic and changes as the suppliers update their filings.

-

GSTR-2B is static and does not change once generated for a month.

GSTR-2B also comes with section-wise advisories, which GSTR-2A lacks. Another difference is the cut-off date: GSTR-2B is generated with a specific cut-off, making it more reliable for filing GSTR-3B.

GSTR-2B vs GSTR-3B: Importance of Matching

It is essential to reconcile GSTR-2B with purchase books before filing GSTR-3B. Some of the key reasons include:

-

Ensuring ITC is not claimed twice.

-

ITC is reversed as per rules where necessary.

-

Tax on RCM is correctly paid.

-

Credit is claimed only if the supplier has actually paid the tax.

Earlier, businesses could claim 5% provisional ITC beyond GSTR-2B data, but this provision was removed effective from 1st January 2022.

Reasons for Mismatch Between GSTR-2B and Purchase Records

There can be several reasons for mismatches, such as:

-

Supplier files invoice in a different tax period.

-

Amendments made by the supplier in later GSTR-1 returns.

-

Credit notes issued not recorded in purchase books.

To reduce such discrepancies, regular follow-ups with vendors and frequent reconciliations are necessary.

Conclusion

GSTR-2B has brought important improvements in the way businesses handle Input Tax Credit reconciliation under GST. With its static nature, structured format, and document-wise details, it has become the go-to tool for businesses to ensure compliance and claim eligible ITC correctly. Matching GSTR-2B with purchase books before filing GSTR-3B is a best practice that helps prevent penalties, interest, and future litigations. As GST regulations evolve, keeping up with changes in GSTR-2B usage, like those proposed in Union Budget 2025, will be important for businesses to stay compliant and tax-efficient.

FAQs

Q1. What is GSTR-2B and how is it different from GSTR-2A?

Ans. GSTR-2B is a static, month-wise auto-drafted Input Tax Credit (ITC) statement available to regular GST taxpayers. It contains eligible and ineligible ITC based on suppliers' filings in GSTR-1, GSTR-5, and GSTR-6. Unlike GSTR-2A, which updates in real-time with every supplier filing, GSTR-2B remains unchanged once generated for a tax period. This makes GSTR-2B more reliable for monthly ITC reconciliation before filing GSTR-3B.

Q2. When is GSTR-2B generated and available on the GST portal?

Ans. GSTR-2B is generated on the 14th of the month following the relevant tax period. For instance, the GSTR-2B for March 2025 will be generated and available on 14th April 2025. It covers data from supplier filings between 14th March 2025 to 13th April 2025.

Q3. Can taxpayers claim ITC based on GSTR-2A if it is missing in GSTR-2B?

Ans. No. After the amendment in Rule 36(4) from 1st January 2022, taxpayers can only claim ITC based on GSTR-2B. GSTR-2A may contain updated or additional invoices, but they cannot be used for provisional credit. Therefore, reconciliation should strictly be based on GSTR-2B to stay compliant.

Q4. What are the common reasons for mismatches between GSTR-2B and purchase records?

Ans. Common mismatches arise due to:\n- Suppliers filing invoices in a different tax period than expected.\n- Supplier amendments in GSTR-1 in later months.\n- Credit notes not recorded in buyer’s books.\n- Supplier missing to file or incorrectly filing the document.\nTo resolve mismatches, communication with vendors is key, and businesses should ensure regular reconciliation post the 14th of every month.

Q5. How can I access GSTR-2B on the GST portal?

Ans. Login to the GST portal, go to the ‘Returns Dashboard’, select the relevant month and year, then click on ‘View’ or ‘Download’ under the GSTR-2B section. For fewer than 1,000 documents, use the ‘View’ option. For more extensive records, download the statement in Excel or JSON format.

Q6. Why is it important to reconcile GSTR-2B with GSTR-3B and purchase records?

Ans. Reconciliation ensures: No double claiming of ITC. ITC reversal is done correctly where required. Reverse charge liabilities are identified and paid. Only eligible ITC is claimed based on supplier compliance. This process helps avoid GST notices, interest (24% per annum), and penalties due to excess or ineligible credit claims.

Q7. What does 'ITC not available' in GSTR-2B mean?

Ans. ‘ITC not available’ refers to invoices or debit notes where credit cannot be claimed due to reasons such as: Time limit under Section 16(4) has lapsed. Place of supply mismatch with supplier and buyer state. Ineligible category of supply under GST rules. These entries help the taxpayer avoid wrong ITC claims and align with the law.

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)

_of_GST_Act_learn_crop10_thumb.jpg)

_Under_GST_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_in_The_Income_Tax_Act,_1961_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_Of_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_for_Import_and_Export_learn_crop10_thumb.jpg)