The Goods and Services Tax (GST) law in India has laid down a strong compliance and audit framework to ensure transparency and minimize tax evasion. One of the essential aspects of this framework is the Internal Audit in GST. Internal audit in GST involves conducting a thorough review of GST returns and related records to ensure compliance with applicable laws and timely identification of discrepancies. Businesses that conduct regular internal audits are better positioned to detect errors early, claim accurate Input Tax Credit (ITC), and respond to any notices from tax authorities effectively. This article explains the role of internal audits in GST and provides a detailed Checklist for GSTR 1, GSTR 3B and GSTR 2B to help businesses maintain compliance and strengthen internal financial controls.

GST Returns & Their Role in Internal Audit

GST returns are periodic filings by registered taxpayers, capturing various details such as outward supplies (sales), inward supplies (purchases), tax paid, and input tax credit claimed. Among these, GSTR-1, GSTR-3B, and GSTR-2B are the most crucial returns for ensuring proper GST compliance.

GSTR-1 is a return that contains detailed invoice-wise information of all outward supplies made by the taxpayer during the month or quarter. GSTR-3B is a summary return, which includes consolidated details of outward supplies, input tax credit claimed, and tax payable. GSTR-2B is an auto-populated return showing the eligible input tax credit available to the taxpayer based on the supplier’s GSTR-1. During internal audits, these returns are reviewed to check whether the data filed is correct, consistent, and matches the books of accounts. Discrepancies among these returns can be a sign of data misreporting, leading to notices and penalties.

Checklist for Auditing GSTR-1

The following are the checklist for Auditing GSTR-1:

Verification of Sales Invoices

The auditor must ensure all B2B (Business-to-Business) and B2C (Business-to-Consumer) invoices are correctly reported in GSTR-1. This includes verifying the GSTINs of recipients in B2B cases and matching invoice values with books of accounts. Any mismatch could lead to GST liability or notices from the department. Accuracy is important to ensure correct tax credit flow to the recipient. Missing invoices can affect revenue recognition and compliance.

Reverse Charge Mechanism (RCM)

Supplies liable under Reverse Charge Mechanism (like legal or transport services) should be recorded separately from normal supplies. The auditor must ensure the supplier has not incorrectly treated them as forward charge supplies. Also, such entries must be visible in GSTR-3B under inward supplies liable to RCM. Failure in RCM compliance may result in underpayment of tax. The business must also self-pay the tax and avail ITC if eligible.

Interstate Supplies to Unregistered Persons

Interstate sales to unregistered persons (e.g., individual consumers in other states) must be reported with proper place of supply details. The auditor should cross-check these with sales ledgers and ensure they are disclosed separately in GSTR-1. Incorrect classification can lead to wrong tax payment—CGST/SGST instead of IGST. Accurate reporting ensures better compliance with Section 10 of the IGST Act. Such supplies often trigger scrutiny if not handled properly.

Zero-Rated and Deemed Exports

The auditor should verify that exports and supplies to SEZs (zero-rated supplies) and deemed exports are correctly disclosed. Supporting documents like shipping bills and LUTs should be checked. These transactions are either exempt or taxable at a reduced rate with refund eligibility. Any omission or incorrect reporting may delay refunds or invite department queries. Proper classification ensures benefit under Section 16 of the IGST Act.

Reporting of Notes and Vouchers

All credit notes, debit notes, and refund vouchers must be recorded in the appropriate sections of GSTR-1. The auditor must verify if these documents are issued within the prescribed time and for valid reasons. These affect the taxable value and tax liability of the supplier. Credit notes should also be accepted by recipients for ITC reversal, if applicable. Timely reporting ensures transparency and proper tax adjustments.

Advance Receipts

Advances received for supply of goods or services must be declared in the month of receipt and later adjusted when actual invoices are issued. The auditor should ensure such advances are tracked and declared in GSTR-1 and GSTR-3B. Ignoring this can result in underreporting of tax liability. Businesses should maintain a clear trail of advances and adjustments. Reconciliation with bank entries and ledgers is key.

HSN Summary Verification

Based on turnover, HSN-wise summary of outward supplies must be reported in GSTR-1. The auditor should verify that the correct HSN codes, units of measurement, quantities, and taxable values are declared. Incorrect HSN usage can lead to classification disputes and tax mismatches. It also affects sectoral data collection by GST authorities. Proper mapping of items with HSN codes as per CBIC notifications is essential.

Invoice Format Compliance

The auditor should check that the invoice format meets GST rules—containing fields like GSTIN of supplier and recipient, invoice number/date, place of supply, tax rate, and amount. Sample invoices should be verified for compliance. Non-compliant invoices may be rejected for ITC or attract penalties under Section 122 of the CGST Act. Ensuring standardization protects against disputes and audit objections.

Place of Supply Details

For interstate supplies, place of supply determines whether CGST/SGST or IGST applies. The auditor should confirm that place of supply is captured correctly on each invoice. Wrong entry can result in wrong tax payment and denial of credit to the buyer. This is especially critical in cross-border state transactions. Errors here often attract notices and payment demands with interest.

Amendments

If any errors or omissions are found in previously filed returns, they should be rectified through amendments in later returns. The auditor must review whether such amendments have been made correctly and within the time limit (by the due date of November of the next financial year). Timely corrections ensure accurate reporting and avoid departmental scrutiny. Documentation of changes should be maintained for audit trail.

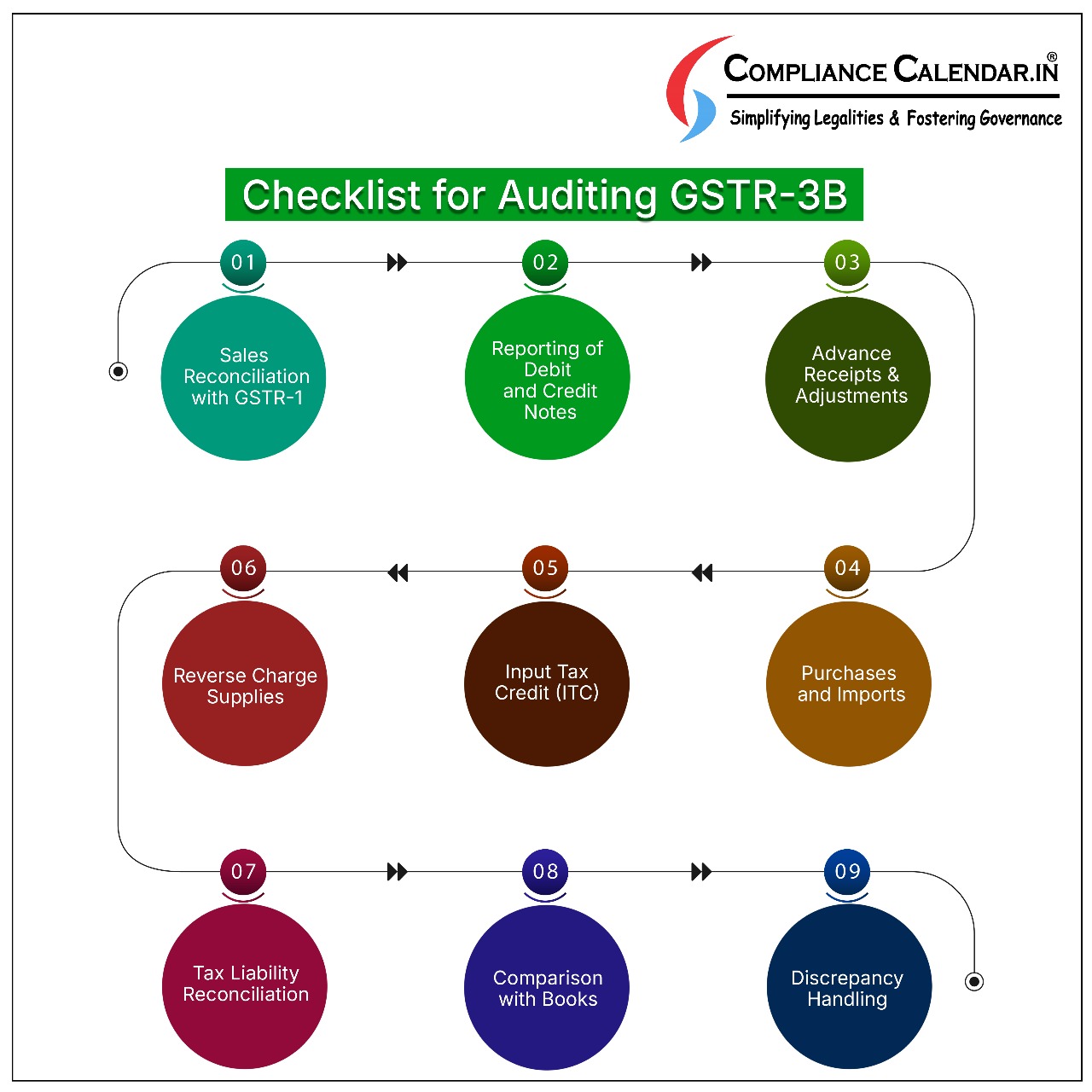

Checklist for Auditing GSTR-3B

The following are the checklist for Auditing GSTR-3B:

Sales Reconciliation with GSTR-1

The auditor must ensure that the total taxable outward supplies reported in GSTR-3B match the detailed invoice-wise data reported in GSTR-1. Any variance can raise red flags during GST audits or assessments. Discrepancies may also impact the recipient’s ability to claim ITC. The reconciliation must be done monthly or quarterly depending on the filing frequency. Accurate reporting ensures compliance and avoids notices.

Reporting of Debit and Credit Notes

Debit and credit notes affect the value of taxable supplies and the corresponding tax amounts. The auditor should verify if these notes are accurately adjusted in GSTR-3B for the respective tax periods. Delayed or omitted adjustments can distort tax liability and cause revenue mismatches. Proper reporting is also crucial for ITC reversal or adjustments on the buyer’s end. Each note must be linked to the original invoice.

Advance Receipts & Adjustments

The auditor should examine whether any advances received are declared in GSTR-3B under the appropriate heads (i.e., taxable advances). When the supply is made, the advance should be adjusted and reported accordingly. Failure to do so may result in double taxation or underpayment. A trail of accounting entries should support such transactions. Proper classification ensures correct tax liability and compliance.

Purchases and Imports

All inward supplies—whether taxable, exempt, nil-rated, or under RCM—should be properly recorded and reported. Imports of goods/services should reflect IGST paid and be matched with Bill of Entry or import documents. The auditor should ensure classification is done as per GST law to claim appropriate ITC or avoid claiming ineligible credit. Exempt and non-taxable purchases must also be clearly segregated for reporting purposes.

Input Tax Credit (ITC)

Auditors must verify that ITC claimed in GSTR-3B is backed by valid tax invoices and matches GSTR-2B. Blocked credits under Section 17(5) (like motor vehicles, personal use expenses) must be excluded. Mismatched credits or ineligible claims may lead to reversals, interest, and penalties. Proper reconciliation with purchase registers and vendor invoices is critical. Documentation must be maintained for future reference or audits.

Reverse Charge Supplies

Under RCM, the recipient is liable to pay tax. The auditor should ensure such inward supplies are declared correctly and tax is paid using cash (not ITC). These should be visible in GSTR-3B under "tax on reverse charge" section. If ITC is eligible, it should be claimed in the same return. Misreporting under RCM is a common audit issue, so due diligence is needed.

Tax Liability Reconciliation

The tax liability shown in GSTR-3B (for CGST, SGST, IGST) must be reconciled with the actual payments made through cash or ITC utilization. The auditor should check the electronic cash ledger and credit ledger for matching values. Any difference may suggest short payment or excess utilization of credit. Timely reconciliation ensures no interest or penalty is incurred and helps maintain clean records.

Comparison with Books

All GST return figures should be cross-verified with the business’s books of accounts, trial balance, and ERP data. This ensures that returns are not only accurate but also aligned with financial reporting. The auditor must pay attention to timing differences, year-end adjustments, or manual errors. Consistency between books and returns supports transparency and defends against scrutiny.

Discrepancy Handling

Any mismatch between GSTR returns and books should be thoroughly investigated. The auditor should identify the reason—whether due to timing issues, incorrect classification, or missed entries—and recommend corrective action. Timely amendments or clarifications in returns can prevent notices, interest, and penalties. Maintaining a discrepancy tracker also helps in audit preparedness and financial accuracy.

Reconciliation & Error Rectification

Reconciliation is an important process in Internal Audit in GST. It involves matching data across different GST returns and comparing with books of accounts. The goal is to ensure consistency and eliminate mismatches.

Key reconciliation areas include:

GSTR-1 vs GSTR-3B

This comparison checks whether invoice-level data reported in GSTR-1 is correctly summarized in GSTR-3B. Discrepancies often result from missed invoices or incorrect taxable values.

GSTR-3B vs GSTR-2B

This is essential for validating Input Tax Credit. If ITC is claimed in GSTR-3B but does not appear in GSTR-2B, it is ineligible and may result in interest liability.

Books vs Returns

Auditor should verify whether all sales and purchases appearing in the books have been reported in GST returns. Any unreported transactions may attract penalties.

Benefits of Internal Audit Under GST

The following are the benefits of Internal Audit under GST:

Error Detection

Internal GST audits help in the early detection of mistakes like incorrect tax rates, wrong HSN/SAC codes, or misclassified supplies. Identifying these errors before return filing or departmental audit helps avoid notices, interest, or penalties. Early correction also improves financial accuracy and compliance.

Compliance Monitoring

Regular audits ensure the business adheres to GST rules, filing deadlines, and document requirements. This proactive check minimizes the chances of missing out on crucial statutory obligations. It also prepares the business for any future government audit or scrutiny.

Internal Control Strengthening

Audits reveal gaps or inefficiencies in the accounting systems, invoicing processes, or tax computations. These insights allow management to implement better checks, workflows, and training, thereby improving overall compliance and operational efficiency.

Accurate ITC Claims

Auditors validate that Input Tax Credit (ITC) is claimed only on eligible purchases, as per GST provisions. This avoids the risk of claiming excess or blocked credits, which could later lead to reversal, interest, or legal issues during departmental audits.

Risk Mitigation

By regularly reviewing GST records, businesses can identify potential risks related to tax demands or non-compliance. Timely detection and rectification reduce exposure to financial penalties, litigation, and reputational damage.

Better Decision Making

Accurate, audit-verified tax data supports strategic financial planning and budgeting. It helps management make informed decisions regarding pricing, vendor selection, and cash flow, ensuring GST liabilities are well managed.

Consolidated Monitoring

For companies with multiple GSTINs across states, internal audits help ensure uniform compliance. It allows the business to compare returns, identify discrepancies between branches, and implement standard procedures for better control and transparency.

GSTR 3B vis-a-vis GSTR 1 & GSTR 2B

Monthly filing of GSTR-3B and invoice-wise filing of GSTR-1 can lead to data mismatches if not reconciled properly. Internal auditors must ensure:

-

The summary of outward supplies in GSTR-3B matches the total of invoices reported in GSTR-1.

-

Classification of supplies like taxable, zero-rated, exempted, and nil-rated is consistent across both returns.

-

ITC claimed in GSTR-3B is supported by GSTR-2B and books.

-

Debit/credit notes are correctly reflected in both GSTR-1 and GSTR-3B.

Interest and Penalties Under GST Act

Under the GST law, claiming excess ITC attracts interest at 24% p.a. If a business claims ITC in excess of what is available in GSTR-2B, interest must be paid on the excess amount. Similarly, if outward supply reported in GSTR-1 is not matched with GSTR-3B, GST officials may impose penalty along with interest. Auditor must reconcile data and advise payment of interest and taxes on or before due dates to avoid litigation and departmental notices.

Amendments in GSTR-1

Any incorrect or missed invoice in GSTR-1 should be rectified in subsequent returns through amendment. Auditor must identify such invoices and advise management to amend them correctly in future returns to ensure clean reporting.

Invoice Particulars Verification

As per GST rules, an invoice must contain specific mandatory details. These include:

-

Name, address, and GSTIN of supplier

-

Invoice number and date

-

HSN code

-

Description of goods or services

-

Tax rate and amount

-

Place of supply (for interstate supplies)

If the format is incorrect or incomplete, penalty up to Rs. 25,000 may apply. The auditor should conduct test checks and recommend revision in invoice templates if required.

180 Days Rule for ITC Reversal

According to GST rules, if payment to the supplier is not made within 180 days of invoice date, the ITC claimed must be reversed. The auditor must:

-

Check payment dates of invoices

-

Ensure that payment equals invoice amount plus GST

-

Identify delays and recommend timely payment

Repeated lapses must be flagged, and the company should be advised to strengthen its payment process.

Review of E-Way Bills vs Invoices

Transport of goods over Rs. 50,000 in value must be accompanied by an e-way bill. Auditor must:

-

Verify if e-way bills are issued where required

-

Match e-way bill details with invoice contents

-

Check for cancellation of e-way bill within 24 hours if unused

Failure to comply with e-way bill provisions can lead to penalties and seizure of goods. Proper internal checks should be recommended.

Non-Motor Vehicle Transport

Some businesses transport goods via bullock carts or hand-pulled vehicles to avoid e-way bill generation. Auditor must investigate such cases where high-value goods are moved without e-way bills. He should confirm if non-motor transport was genuine or misused to bypass compliance.

Conclusion

Internal Audit in GST is not just a compliance exercise but an important tool for identifying errors, strengthening processes, and safeguarding a business from penalties. By using a complete Checklist for GSTR 1, GSTR 3B and GSTR 2B, businesses can detect discrepancies early, rectify errors, and maintain clean records. With increasing scrutiny from GST authorities, a strong internal audit mechanism is indispensable for every GST-registered entity.

FAQs

Q1. What is the purpose of an internal audit in GST?

Ans. Internal audit in GST is conducted to ensure that GST returns and records are accurate, compliant, and free from errors or fraud. It helps businesses detect mismatches between GSTR-1, GSTR-3B, and GSTR-2B, verify correct input tax credit claims, and avoid penalties due to non-compliance.

Q2. Why is reconciliation between GSTR-1 and GSTR-3B important?

Ans. Reconciliation between GSTR-1 and GSTR-3B ensures that the invoice-wise outward supplies reported in GSTR-1 match the summarized sales figures declared in GSTR-3B. Any mismatch may attract scrutiny from tax authorities and could lead to penalties or show-cause notices.

Q3. How does GSTR-2B help in internal audit of GST?

Ans. GSTR-2B is an auto-generated statement showing eligible input tax credit based on the suppliers’ GSTR-1. It serves as a base for claiming ITC in GSTR-3B. During an internal audit, comparing ITC claimed in GSTR-3B with GSTR-2B helps prevent excess or ineligible ITC claims.

Q4. What are the consequences of not paying the invoice amount within 180 days?

Ans. If a business fails to pay the invoice amount plus GST to the supplier within 180 days of the invoice date, the claimed input tax credit must be reversed. The reversed amount is added to the output tax liability and attracts interest under GST law.

Q5. How should an internal auditor check compliance with e-way bill rules?

Ans. The auditor should verify if e-way bills are generated for all movements of goods exceeding Rs. 50,000 in value. The details on the e-way bill must match the sales or purchase invoice. Failure to generate an e-way bill can lead to seizure of goods and penalties.

Q6. Can errors in GSTR-1 be corrected? If yes, how?

Ans. Yes, errors in GSTR-1 can be corrected by filing an amendment in subsequent returns. The internal auditor should identify such errors and recommend timely corrections to avoid discrepancies between returns and ensure proper GST compliance.

Q7. What are the benefits of regularly conducting internal GST audits?

Ans. Regular internal GST audits help in early detection of errors, proper input tax credit management, compliance with return filing, improved internal controls, reduced risk of penalties, and better preparedness for departmental audits or assessments.

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)

_of_GST_Act_learn_crop10_thumb.jpg)

_Under_GST_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_in_The_Income_Tax_Act,_1961_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_Of_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_for_Import_and_Export_learn_crop10_thumb.jpg)