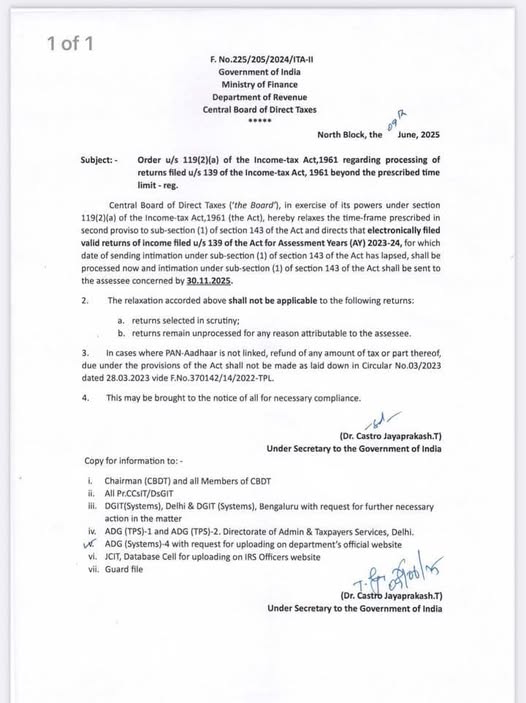

In a significant relief to taxpayers, the Central Board of Direct Taxes (CBDT) has issued an order dated June 2025 under Section 119(2)(a) of the Income-tax Act, 1961. This order extends the timeline for processing certain updated income tax returns (ITRs) filed under Section 139(1) for the Assessment Year (AY) 2023-24 that remained unprocessed beyond the prescribed time limit. The move provides much-needed clarity and compliance relief to taxpayers awaiting processing and refunds.

This article explains the key highlights of the order, its background, exclusions, and the steps taxpayers must take to ensure proper compliance.

Legal Basis of the Order: Section 119(2)(a) of the Income-tax Act, 1961

The Central Board of Direct Taxes (CBDT) exercises powers under Section 119(2)(a) of the Income-tax Act, 1961. This provision authorizes the CBDT to issue orders, instructions, or directions for proper administration of the Act to reduce genuine hardship faced by taxpayers.

In this case, the CBDT has exercised this power to relax the time limit under the second proviso to Section 143(1) of the Act, which generally prescribes the time frame for processing returns filed under Section 139(1).

Purpose of the Order

The main intent of this order is to enable the processing of electronically filed income tax returns (ITRs) for AY 2023-24 that have remained unprocessed beyond the statutory time limit. These returns were filed on time under Section 139(1) but failed to receive the necessary intimation under Section 143(1) due to systemic or procedural delays.

Applicability of the CBDT Order

This order applies specifically to:

-

Electronically filed valid returns under Section 139(1) of the Income-tax Act, 1961 for the Assessment Year 2023-24.

-

Returns for which intimations under Section 143(1) were not sent within the prescribed timeframe.

As per the order, such returns shall now be processed, and the necessary intimations will be sent to the taxpayers by 30.11.2025.

This extension ensures that eligible taxpayers do not suffer delays in processing, refunds, or further tax compliance due to delays not attributable to them.

Section 143(1) of the Income-tax Act: A Quick Overview

Section 143(1) deals with the preliminary assessment of ITRs. Under this section, the return filed by the taxpayer is processed, and the system computes:

-

Total income or loss after adjustments

-

Any arithmetical error or incorrect claims apparent from the return

-

Refunds due or taxes payable

As per the provisions, intimation under Section 143(1) should generally be sent within 9 months from the end of the financial year in which the return is filed. However, delays may occur due to technical reasons or system issues.

The present order removes this time barrier and allows CBDT to process delayed returns.

New Deadline for Processing: 30 November 2025

The CBDT has now set 30.11.2025 as the new deadline to process these delayed returns and issue the necessary intimations under Section 143(1).

This will benefit taxpayers whose returns remained in limbo due to missed timelines, thereby enabling processing and refund issuance.

Important Exclusions: When the Relaxation Does Not Apply

CBDT has also clarified that this relaxation shall NOT apply in the following cases:

Returns Selected for Scrutiny

If a return has been picked up for scrutiny under Section 143(2) or otherwise, the provisions of this order will not apply. Such cases are subject to a detailed examination and not eligible for routine processing under Section 143(1).

Returns Unprocessed for Reasons Attributable to the Assessee

If the delay in processing is due to reasons attributable to the taxpayer—such as non-verification of return, incorrect details, or failure to respond to queries—then this relaxation does not extend to such cases.

PAN-Aadhaar Not Linked

If the Permanent Account Number (PAN) of the taxpayer is not linked with Aadhaar, any refund due under such return will not be issued. This is in accordance with Circular No. 03/2023 dated 28.03.2023.

Therefore, taxpayers must ensure that their PAN is linked with Aadhaar to receive refunds.

Relevant Circular: No. 03/2023 dated 28.03.2023

This earlier circular made it mandatory for PAN to be linked with Aadhaar for processing certain transactions, including refund disbursement. The current order reiterates that linking PAN and Aadhaar is a pre-requisite for the relaxation to be effective in refund cases.

Compliance Requirements for Taxpayers

Taxpayers falling under the eligible category must:

-

Ensure that the return was filed under Section 139(1) for AY 2023-24

-

Verify if the return is still unprocessed

-

Check that PAN is linked with Aadhaar

-

Not fall under the exclusion categories (e.g., scrutiny cases)

No separate application is needed to benefit from this order. The Income Tax Department will process eligible returns suo motu before 30.11.2025.

Role of Income Tax Authorities

The CBDT has issued directions to:

-

Chairman and Members of the CBDT

-

All Principal Chief Commissioners/Chief Commissioners of Income Tax

-

DGIT (Systems) in Delhi and Bengaluru for necessary system-level actions

-

ADG (TPS-2) for website uploading

-

Database Cell for IRIS and Officer’s access

This ensures that the order is effectively implemented at all levels and reaches the concerned taxpayers.

Conclusion

CBDT’s June 2025 order is a welcome relief for lakhs of taxpayers who have been awaiting processing and refunds for their ITRs of AY 2023-24. By extending the timeline and ensuring systemic compliance, the government ensures fairness and efficiency. Taxpayers should verify their return status, ensure Aadhaar linking, and stay informed through the official income tax portal to benefit from this initiative.

For further clarification or assistance, consulting a professional tax advisor is advisable.

Frequently Asked Questions (FAQs)

Q1. What is the purpose of the CBDT Order issued in June 2025?

Ans. The order allows the processing of ITRs filed under Section 139(1) for AY 2023-24 that missed the time limit for processing under Section 143(1).

Q2. Who is eligible under this relaxation?

Ans. Taxpayers who filed valid, electronic returns under Section 139(1) for AY 2023-24 but did not receive an intimation under Section 143(1) within the prescribed time.

Q3. What is the new processing deadline under this order?

Ans. The new deadline for processing these delayed returns is 30th November 2025.

Q4. Will refunds be issued in these cases?

Ans. Yes, but only if the PAN is linked with Aadhaar as per Circular No. 03/2023.

Q5. Are scrutiny cases covered under this order?

Ans. No. Returns selected for scrutiny are explicitly excluded from this relaxation.

Q6. What if the delay was caused by the taxpayer?

Ans. If the return remained unprocessed due to reasons attributable to the taxpayer, such as failure to verify the return, the relaxation will not apply.

Q7. Is any action required from the taxpayer?

Ans. No specific action is required except ensuring PAN-Aadhaar linking and checking the return status.

Q8. What sections of the Income-tax Act are involved here?

Ans. The order refers to Section 119(2)(a), Section 139(1), and Section 143(1) of the Income-tax Act, 1961.

Q9. Will this order apply to belated or revised returns?

Ans. No. The order is limited to original returns filed under Section 139(1) only.

Q10. How will taxpayers know if their return has been processed?

Ans. Taxpayers can check the status on the Income Tax e-filing portal or receive the intimation directly via email/SMS.

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)

_of_GST_Act_learn_crop10_thumb.jpg)

_Under_GST_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_in_The_Income_Tax_Act,_1961_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_Of_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_for_Import_and_Export_learn_crop10_thumb.jpg)