The Government of India has introduced the Next-Generation GST Reform as a festive gift to the nation, bringing relief to households, farmers, enterprises, and businesses. This reform aims to make life simpler and more affordable for every citizen by reducing taxes on essential goods, education, healthcare, agriculture, automobiles, and electronic appliances.

The new GST regime promises to make the tax system better and simpler, ensuring that everyday essentials, healthcare services, and farming equipment become more affordable. It also focuses on supporting small and medium businesses, generating economic activity, and boosting the ease of living for people.

Let us understand in detail the key highlights of this reform and how it impacts different sectors.

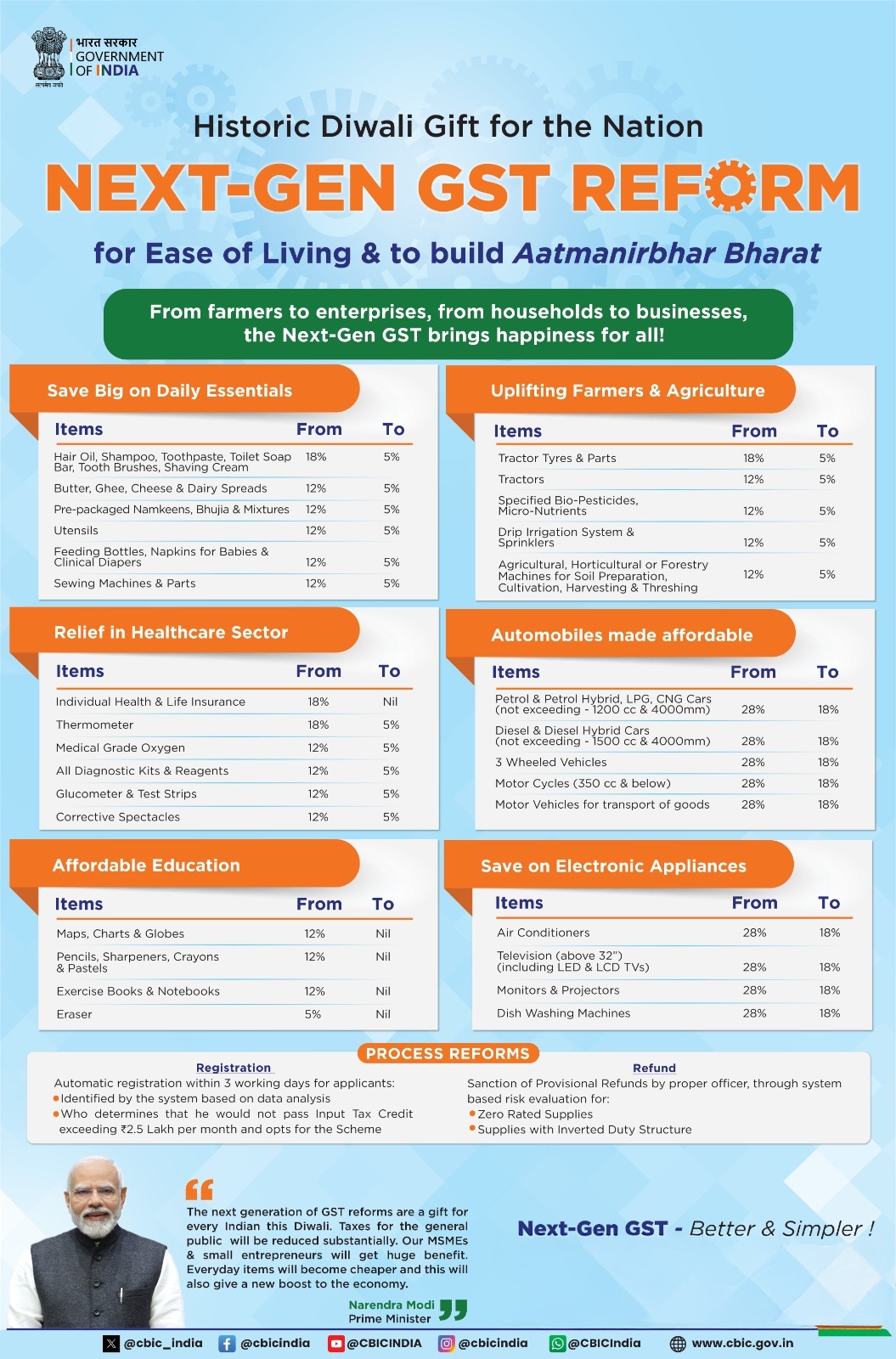

Save Big on Daily Essentials

One of the most direct benefits of the reform can be seen in daily household essentials. Earlier, many commonly used items were taxed at a higher rate, making them costlier for the average family. With the new GST rates, essential items have become more affordable.

-

Personal Care Products like hair oil, shampoo, toothpaste, shaving cream, and toilet soap bars were earlier taxed at 18%, but now the tax has been reduced to just 5%. This reduction will directly help households save more on everyday hygiene and grooming needs.

-

Food Products such as butter, ghee, cheese, and dairy spreads, along with pre-packaged namkeens, bhujia, and mixtures, which earlier attracted 12% GST, will now be available at 5% GST. This will bring relief to millions of households that rely on these products daily.

-

Utensils, feeding bottles and napkins for babies, and sewing machines with parts have all seen a reduction from 12% GST to 5% GST. These changes reflect the government’s intention to support middle-class families and promote domestic consumption.

This step ensures that the cost of living is reduced, and families can manage their monthly budgets more efficiently.

Uplifting Farmers and Agriculture

The backbone of India’s economy is its farmers, and this reform gives them substantial relief. Agricultural tools, machinery, and parts that were heavily taxed earlier are now more affordable.

-

Tractor tyres and parts, which were earlier taxed at 18%, will now attract only 5% GST. Similarly, tractors themselves have seen a reduction from 12% to 5%, making them more accessible to farmers.

-

Bio-pesticides, micro-nutrients, drip irrigation systems, and sprinklers will now be available at a reduced GST of 5%, compared to the earlier 12%. This will help farmers adopt modern farming techniques without the burden of high taxes.

-

Agricultural, horticultural, and forestry machinery for soil preparation, cultivation, harvesting, and threshing will now also come under 5% GST instead of 12%.

These reforms will not only make farming more economical but will also encourage the adoption of better agricultural practices, leading to higher productivity and better incomes for farmers.

Relief in Healthcare Sector

The healthcare sector has been given special attention under the Next-Gen GST. Health is one area where affordability is critical, and the government has ensured that essential medical goods and services become cheaper.

-

Individual health and life insurance, which was earlier taxed at 18% GST, will now be completely tax-free (Nil). This move will encourage more people to take insurance policies for financial security.

-

Thermometers, medical-grade oxygen, diagnostic kits and reagents, glucometers and test strips, and even corrective spectacles have all seen a reduction from 12% to 5% GST.

This step is a huge relief for patients and families who often struggle with healthcare costs. It ensures that medical products are more affordable and accessible, leading to better health outcomes across the country.

Affordable Education

Education is the foundation of a strong nation, and this reform makes learning materials more affordable for students and parents.

-

Maps, charts, globes, pencils, sharpeners, crayons, pastels, exercise books, and notebooks which were earlier taxed at 12% GST will now be completely tax-free (Nil).

-

Even small items like erasers, which earlier attracted 5% GST, will now also be tax-free.

This reduction will benefit millions of school-going children, especially in lower-income families, by reducing the financial burden of education-related expenses. By making educational items more affordable, the government is ensuring that no child is deprived of learning due to high costs.

Automobiles Made Affordable

The automobile sector is another area that has seen significant changes. Earlier, cars and bikes attracted some of the highest GST rates, making them costly for common people. The reforms aim to make vehicles more accessible.

-

Petrol and diesel hybrid cars, LPG and CNG cars (with engine capacity not exceeding 1200 cc and length up to 4000 mm) earlier attracted 28% GST, which has now been reduced to 18%.

-

Diesel and hybrid cars (with engine capacity not exceeding 1500 cc and length up to 4000 mm) also see a reduction from 28% to 18%.

-

Three-wheeled vehicles, motorcycles (350 cc and below), and even motor vehicles for the transport of goods will now attract 18% GST instead of the earlier 28%.

This move will make personal transport, commercial vehicles, and goods transportation more affordable, ultimately reducing logistics costs across industries.

Save on Electronic Appliances

Electronic appliances are part of every modern household, but high taxes earlier made them expensive. The new GST regime brings major relief to families.

- Air conditioners, televisions (above 32 inches including LED & LCD TVs), monitors, projectors, and dishwashing machines will all see a reduction from 28% GST to 18% GST.

This reduction will encourage households to invest in better appliances, improve their quality of life, and boost the electronics market in India.

Process Reforms

Apart from reducing taxes, the government has also introduced process reforms to make GST compliance easier for businesses.

-

Registration Simplified: Automatic registration will now be provided within three working days for applicants. This will be based on system data analysis, reducing manual intervention.

-

Applicants exceeding Rs.2.5 lakh per month in input tax credit can also opt for this simplified scheme.

-

Refunds Simplified: Refunds of provisional duty will now be sanctioned through a system-based risk evaluation process.

-

Refunds will be faster for zero-rated supplies and supplies with an inverted duty structure.

These reforms are aimed at reducing the compliance burden on small and medium enterprises (SMEs) and making tax administration more transparent.

Prime Minister’s Message

Prime Minister Narendra Modi has called this reform a gift for every Indian this Diwali. He emphasized that the reduction in taxes will provide substantial relief to households and businesses alike. He also highlighted that MSMEs and small entrepreneurs will greatly benefit from lower tax rates, boosting both consumption and economic growth. Everyday items will become cheaper, and this will also give a strong push to India’s economy.

FAQs

Q1. What is the main purpose of the Next-Gen GST reform?

Ans. The reform aims to reduce taxes on essential goods, services, and sectors to make life easier for citizens and boost economic growth.

Q2. Which household essentials have become cheaper?

Ans. Personal care products, butter, ghee, cheese, pre-packaged namkeens, utensils, baby products, and sewing machines are now taxed at only 5%.

Q3. How has the healthcare sector benefited?

Ans. Insurance premiums are now tax-free, while medical items like thermometers, oxygen, diagnostic kits, glucometers, and spectacles are taxed at only 5%.

Q4. What changes have been made for farmers?

Ans. Tractors, tractor tyres, bio-pesticides, micro-nutrients, drip irrigation systems, and farm machinery now attract only 5% GST.

Q5. Has education been made tax-free?

Ans. Yes. Items like pencils, sharpeners, crayons, maps, notebooks, and erasers are now completely exempt from GST.

Q6. How does this reform affect the automobile industry?

Ans. Cars, motorcycles, three-wheelers, and goods transport vehicles that earlier attracted 28% GST will now be taxed at 18%.

Q7. What about electronic appliances?

Ans. Air conditioners, televisions above 32 inches, monitors, projectors, and dishwashers now have a reduced GST of 18% instead of 28%.

Q8. How have GST processes been simplified?

Ans. Automatic registration within three working days and faster refunds through a risk-based system have been introduced.

Q9. Who will benefit most from these changes?

Ans. Households, farmers, students, patients, and small businesses will benefit the most as their costs reduce significantly.

Q10. How does this reform support the economy?

Ans. By reducing prices, it increases consumption, supports MSMEs, boosts manufacturing, and helps in creating more jobs, thereby strengthening the economy.

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)

_of_GST_Act_learn_crop10_thumb.jpg)

_Under_GST_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_in_The_Income_Tax_Act,_1961_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_Of_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_for_Import_and_Export_learn_crop10_thumb.jpg)