The Central Board of Direct Taxes (CBDT) has officially announced the extension of the due date for filing Income Tax Returns (ITRs) for the Assessment Year (AY) 2025-26. Originally set for 31st July 2025, the deadline is now extended to 15th September 2025. This article will walk you through the reasons behind this extension, the implications for taxpayers, and the broader context of why such extensions matter. Let’s break it down in simple, easy-to-follow sections.

Background: What Is the CBDT?

The Central Board of Direct Taxes (CBDT) is the governing body under the Ministry of Finance, responsible for administering direct tax laws in India. This includes overseeing the implementation and compliance of the Income Tax Act, 1961, issuing policy directives, monitoring tax collections, and providing necessary clarifications through circulars, press releases, and notifications.

In short, whenever there’s a change in tax procedures or deadlines, it usually comes directly from the CBDT.

What Was Announced?

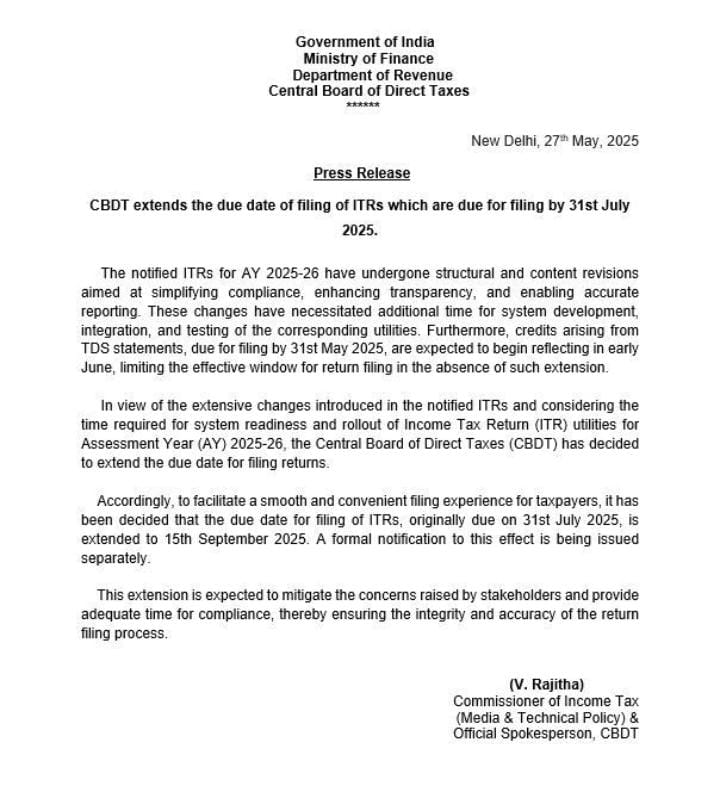

On May 27, 2025, the CBDT issued a press release announcing that the due date for filing ITRs, which was initially scheduled for 31st July 2025, has now been extended to 15th September 2025. This extension applies specifically to the returns meant for the financial year 2024-25 (AY 2025-26).

Why Was This Extension Announced?

The key reason behind the extension is that the notified ITR forms for AY 2025-26 have undergone significant structural and content revisions. These changes were introduced to:

-

Simplify compliance for taxpayers,

-

Increase transparency in reporting,

-

Enable more accurate data reporting to the Income Tax Department.

Due to these changes, the development and testing of the software utilities needed for ITR filing have taken longer than usual. Without sufficient system readiness, taxpayers would face technical difficulties, making it harder to file their returns on time.

Structural and Content Revisions in ITRs

The ITR forms for this year are not just simple updates; they include fundamental changes in layout, disclosure requirements, and backend data processing. These updates are designed to:

-

Automate cross-checking between ITR data and TDS (Tax Deducted at Source) statements,

-

Integrate better with GST filings and other third-party data,

-

Reduce manual interventions, making filings smoother and faster.

Because these changes touch both the front-end forms (that taxpayers fill) and the back-end systems (that the tax department uses), additional time is needed for proper integration and testing.

Impact of TDS Statement Deadlines

Another reason mentioned in the press release is the timing of TDS credits. TDS statements, which are due for filing by 31st May 2025, are expected to start reflecting in the tax system only by early June. This creates a narrow window for taxpayers to reconcile their tax credits and file accurate returns before the original 31st July deadline.

Without an extension, many taxpayers would rush to file returns without fully reconciled TDS data, leading to errors, mismatches, or delays in tax refunds.

New Due Date: 15th September 2025

With all these factors in mind, the CBDT has officially extended the ITR filing deadline to 15th September 2025. This extension applies to individual taxpayers and others who were originally supposed to file by 31st July 2025.

The formal notification for this extension will be issued separately and will provide the legal backing for the extension. This is a routine process, where the press release gives the immediate update, and the detailed notification follows.

Why Extensions Like This Matter

Filing an Income Tax Return is not just about submitting numbers; it involves reviewing Form 26AS, AIS/TIS reports, TDS credits, deductions, exemptions, and ensuring the return matches all official records. If system updates or credit reflections are delayed, taxpayers are left in the dark, increasing the risk of errors.

An extension provides:

-

Adequate time for taxpayers to cross-check their tax data,

-

More time for tax professionals to handle client filings,

-

Smoother processing of returns by the tax department.

Most importantly, it reduces the panic and technical load on the online filing systems during the peak deadline period.

Benefits for Taxpayers

This extension is beneficial because it:

-

Reduces last-minute rush,

-

Gives more time to reconcile TDS and other tax credits,

-

Allows taxpayers to file accurate returns, avoiding notices or penalties,

-

Provides relief to tax professionals and consultants who manage hundreds of filings,

-

Improves the overall efficiency and accuracy of the tax filing system.

Key Takeaways from the Press Release

1. Who Issued It?

The CBDT under the Ministry of Finance, Government of India.

2. What Did It Announce?

The due date for filing ITRs for AY 2025-26 has been extended from 31st July 2025 to 15th September 2025.

3. Why Was It Extended?

Due to structural and content changes in the ITR forms, system integration and testing delays, and the time required for reflecting TDS credits.

4. Who Benefits?

All taxpayers who were required to file ITRs by 31st July 2025, primarily individual taxpayers and non-audit cases.

5. When Will the Formal Notification Be Issued?

A separate notification will follow shortly to formalize the extension.

Implications for Non-Compliance

While the extension provides extra time, taxpayers should not delay their filings unnecessarily. Missing the extended deadline of 15th September 2025 may still attract:

-

Late filing fees under Section 234F of the Income Tax Act,

-

Interest on any unpaid tax liability under Sections 234A, 234B, and 234C,

-

Possible delays in refund processing.

Therefore, it’s advisable to use this additional time wisely to ensure accurate and timely filing.

Next Steps for Taxpayers

Here’s what taxpayers should do now:

-

Wait for the updated ITR utilities to be released.

-

Review Form 26AS, AIS (Annual Information Statement), and TIS (Taxpayer Information Summary).

-

Gather all income and deduction documents.

-

Consult your tax consultant or accountant if needed.

-

Aim to file well before the new deadline to avoid last-minute issues.

The Road Ahead

The CBDT’s decision reflects a taxpayer-friendly approach, ensuring that system readiness does not become a hurdle to compliance. With continuous updates to tax systems, digital filings, and cross-linkages between various tax records, the future will likely see more streamlined filings — but these improvements come with their own implementation timelines.

Conclusion

The CBDT’s move to extend the ITR filing deadline is a welcome step, providing much-needed breathing room for taxpayers and tax professionals alike. With system updates, integration challenges, and data accuracy becoming critical parts of the compliance landscape, this extension helps ensure that taxpayers can fulfill their obligations without unnecessary stress. However, it’s important not to procrastinate — use this time wisely, prepare your documents, and file early to stay ahead.

If you need further updates or want to stay informed, regularly check the official Income Tax portal and CBDT press releases.

FAQs on CBDT’s ITR Filing Extension (2025)

Q1. What is the new due date for filing ITRs for AY 2025-26?

Ans. The new due date is 15th September 2025, extended from the original 31st July 2025.

Q2. Why did the CBDT extend the ITR filing deadline?

Ans. Because of structural and content changes in ITR forms, system integration delays, and the time needed to reflect TDS credits.

Q3. Does this extension apply to all taxpayers?

Ans. It applies mainly to individual taxpayers and non-audit cases due by 31st July 2025.

Q4. Will there be a separate formal notification?

Ans. Yes, the press release mentioned that a formal notification will be issued separately.

Q5. What happens if I still miss the extended deadline?

Ans. You may face late filing fees, interest on unpaid taxes, and delays in refund processing.

Q6. Do I still need to reconcile TDS and income data before filing?

Ans. Yes, reconciliation is essential to avoid mismatches and future tax notices.

Q7. Can I file my ITR before the extended deadline?

Ans. Yes, you can file as soon as the updated ITR utilities are available.

Q8. Will my tax consultant automatically handle the deadline change?

Ans. It’s best to check with your tax consultant, but most professionals will follow the updated deadlines.

Q9. Does this extension apply to audit cases or companies?

Ans. No, this extension is primarily for non-audit taxpayers; audit cases have separate deadlines.

Q10. Where can I check the official notification?

Ans. Keep an eye on the official Income Tax India website (www.incometax.gov.in) or CBDT circulars.

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)

_of_GST_Act_learn_crop10_thumb.jpg)

_Under_GST_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_in_The_Income_Tax_Act,_1961_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_of_the_Income_Tax_Act_learn_crop10_thumb.jpg)

_Of_Income_Tax_Act_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_for_Import_and_Export_learn_crop10_thumb.jpg)