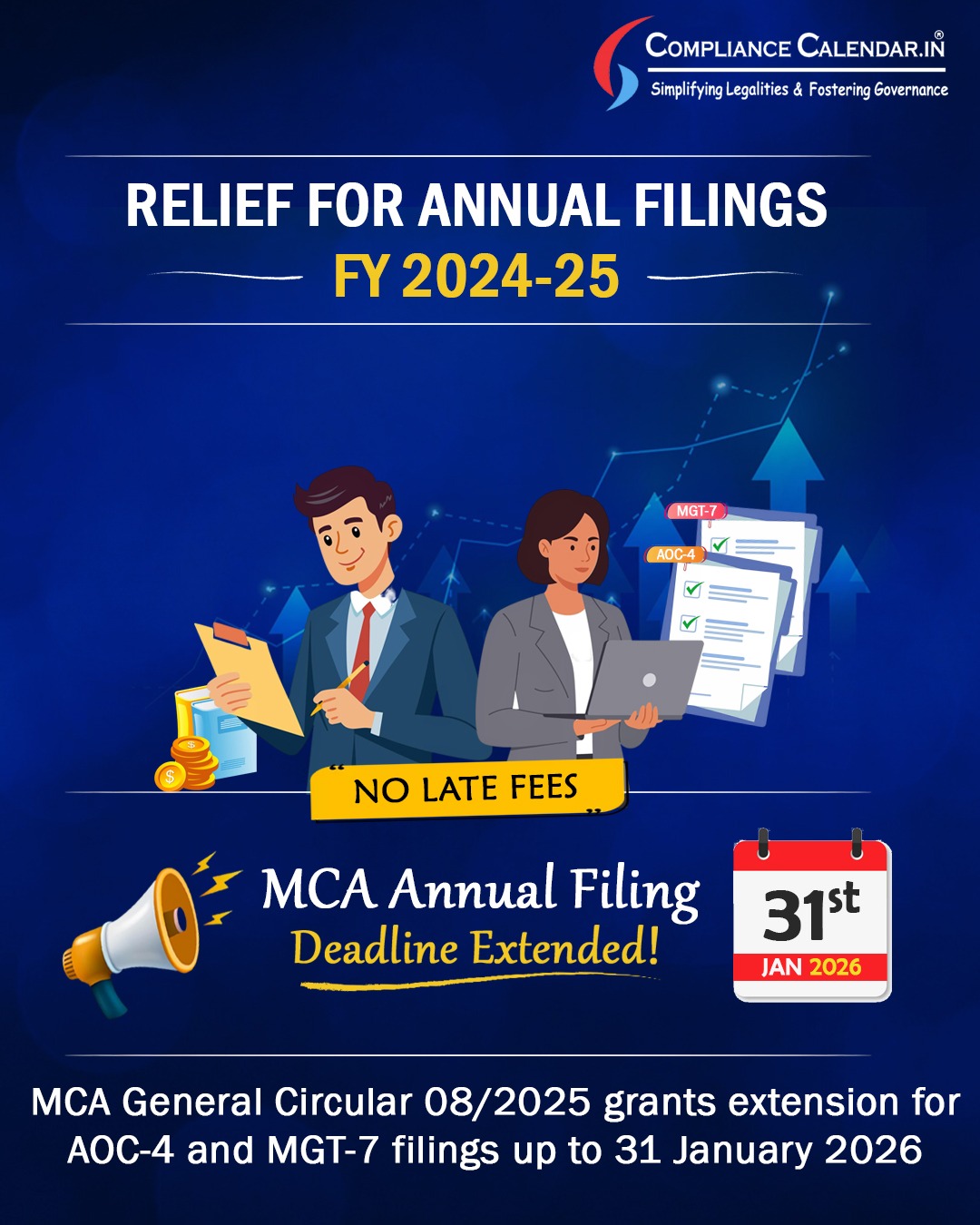

MCA Extends Due Date for AOC-4 and MGT-7 Filing Till 31 January 2026 – General Circular No. 08/2025

The Ministry of Corporate Affairs (MCA) has issued General Circular No. 08/2025 dated 30 December 2025, granting much-needed relief to companies by extending the due date for filing Annual Returns and Financial Statements for FY 2024–25 without any additional fees.

This extension allows companies to complete their pending annual filings up to 31 January 2026, offering a final opportunity to regularise compliance under the Companies Act, 2013 without attracting late filing penalties.

Background of MCA General Circular No. 08/2025

Over the past few months, the MCA has received multiple representations from companies and professionals highlighting practical difficulties in completing annual filings on time. These challenges included:

- Delays in finalisation of audited financial statements

- Heavy compliance workload during the year-end period

- Technical issues on the MCA portal

- Complex reporting requirements, especially for NBFCs and Ind AS-compliant entities

Considering these genuine difficulties, the MCA had earlier issued General Circular No. 06/2025 dated 17 October 2025, granting certain relaxations. However, as compliance bottlenecks continued, the MCA has now issued General Circular No. 08/2025, extending the relief further.

This move reflects the government’s continued effort to promote ease of doing business while ensuring that companies remain compliant with statutory requirements.

Key Highlights of MCA Circular 08/2025

- Extended filing deadline: 31 January 2026

- Additional fees: Fully waived

- Financial year covered: FY 2024–25

- Forms covered: Annual Returns and Financial Statements

- Legal framework: Companies Act, 2013

The relaxation applies only to the specified forms and is strictly limited to FY 2024–25 filings.

Extended Due Date for Annual Filings – What Has Changed?

Under normal circumstances, delayed filing of AOC-4 and MGT-7 attracts substantial additional fees, calculated on a per-day basis. In many cases, penalties run into thousands or even lakhs of rupees.

Through this circular, the MCA has allowed companies to file their pending annual compliance forms on or before 31 January 2026, without payment of any additional fees, even if the original statutory due date has already expired.

This effectively gives companies a penalty-free window to complete their annual filings.

MCA Forms Covered Under the Extension

The relaxation under General Circular No. 08/2025 applies to the following forms:

1. MGT-7

Annual Return filed by companies other than OPCs and companies covered under MGT-7A.

2. MGT-7A

Annual Return for:

- One Person Companies (OPCs)

- Companies not required to hold AGM

3. AOC-4

Filing of standalone financial statements.

4. AOC-4 XBRL

For companies required to submit financial statements in XBRL format.

5. AOC-4 CFS

For filing consolidated financial statements.

6. AOC-4 NBFC (Ind AS)

Applicable to NBFCs following Ind AS.

7. AOC-4 CFS NBFC (Ind AS)

For NBFCs filing consolidated Ind AS financials.

This coverage ensures that almost all categories of companies, including NBFCs and large corporates, benefit from the relaxation.

Important Conditions to Note

While the circular provides major relief, companies must keep the following points in mind:

- The extension applies only to additional fees; filing itself remains mandatory

- All other conditions of General Circular No. 06/2025 remain unchanged

- The relaxation is applicable only for FY 2024–25

- Any filing done after 31 January 2026 will attract normal penalties

Companies should treat this as a final opportunity, not an indefinite extension.

Why This MCA Extension Is Significant for Companies

1. Avoidance of Heavy Late Fees

Late filing fees for AOC-4 can go up to INR 2,00,000, and for MGT-7 up to INR 1,00,000. This circular helps companies save significant compliance costs.

2. Protection from Compliance Consequences

Non-filing or delayed filing can lead to:

- Director disqualification

- Difficulty in obtaining bank finance

- Adverse compliance rating

- Legal scrutiny

Timely use of this extension helps companies avoid these risks.

3. Relief for Startups and MSMEs

Smaller companies often face resource constraints. This extension provides them extra time to complete filings without financial pressure.

Who Should Take Immediate Action?

This circular is particularly relevant for:

- Companies that missed original FY 2024–25 filing deadlines

- NBFCs and Ind AS-compliant entities

- Companies with pending consolidated financial statements

- OPCs and small companies

- Professionals handling bulk client compliance

If your AOC-4 or MGT-7 is still pending, you should act immediately.

Practical Compliance Checklist Before Filing

Before proceeding with filing under this extension, ensure that:

- Financial statements are duly audited

- AGM or relevant resolutions are properly recorded

- Director and shareholding details are updated

- Digital Signature Certificates (DSC) are valid

- Correct form variant (normal / XBRL / Ind AS) is selected

Proper preparation avoids last-minute rejections or resubmissions.

Expert Advisory for Companies and Professionals

Although the deadline has been extended, companies should avoid waiting until the last day. Historically, the MCA portal experiences heavy traffic close to deadlines, which can result in:

- Portal downtime

- Payment gateway failures

- Upload and validation errors

Early filing ensures smooth compliance and peace of mind.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_Second_Amendment_Rules,_2025_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_learn_crop10_thumb.jpg)

_rd_roc_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpeg)