The Reserve Bank of India (RBI) has recently rolled out two major updates that significantly ease the process of foreign investment compliance by filing FCGPR at FIRMS Portal under FEMA, 1999, which pertain to:

-

Modification Option for FC-GPR Forms filing/No rejection directly

-

Simplified Reporting of Foreign Investment in Single Master Form (SMF)

-Reporting-on-FIRMS-Portal.jpg)

Together, these measures make the FIRMS Portal more efficient, transparent, and user-friendly for companies, professionals, and Authorised Dealer (AD) banks.Hence the above new update particularly benefits Compliance Calendar LLP , a team of professionals such as Company Secretaries and also helps startups, and compliance officers handling regular FDI inflows and share allotment compliances.

Now, Modification option for FC-GPR enabled on FIRMS Portal

Until recently, if an FC-GPR form filed on the FIRMS Portal was rejected by the AD Bank, applicants were compelled to start from scratch, re-enter all form data, re-upload documents, and initiate a fresh submission and these repetitive process created compliance fatigue and delayed statutory timelines along with another fresh query in each application.

However, RBI has now enabled a modification feature for FC-GPR filings on the FIRMS Portal, welcome and much-needed change.

What’s New:

-

Applicants can now edit the same FC-GPR form based on the AD Bank’s observations.

-

There is no need to create a new form or upload all documents afresh.

-

Once corrections are made, the same form can be resubmitted, streamlining the overall process and fast FDI approval.

How beneficial ?

|

Earlier |

Now |

|

Fresh form had to be created on rejection |

Existing form can be edited |

|

Full re-entry of data and documents |

Minimal correction and resubmission |

|

High time and effort required |

Significant reduction in compliance burden |

|

Higher chance of delays and non-compliance |

Timely resolution and efficiency |

Simplified SMF Filing Procedure Introduced by RBI

We all know that, RBI has also simplified the reporting process through (RBI A.P. (DIR Series) Circular No. 22 dated January 4, 2023) for foreign investment using the Single Master Form (SMF) through the FIRMS Portal, an update introduces a streamlined, time-bound, and fully digital workflow.

Simplified SMF Process (Foreign Investment in India - Rationalisation of reporting in Single Master Form (SMF) on FIRMS Portal)

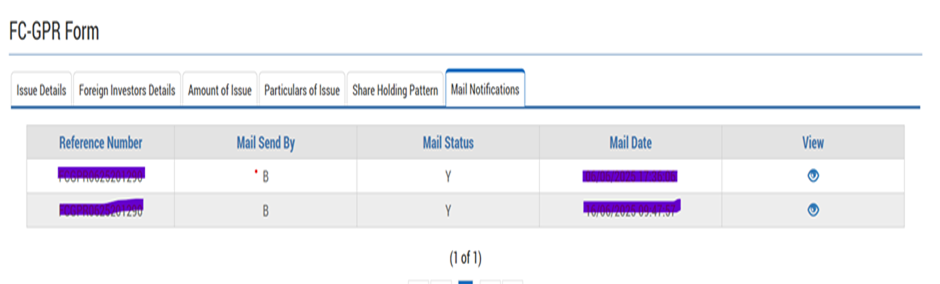

1. Auto-Acknowledgement of Forms

-

Once submitted, forms are auto-acknowledged with a timestamp on FIRMS Portal.

- An automated email is sent to the applicant.

2. AD Bank Review Within 5 Working Days

- The form and uploaded documents will be verified by the Authorised Dealer (AD) Bank within five working days.

3. Clear Protocol for Delayed Submissions

-

If the reporting is delayed up to 3 years, the applicant is directed to pay the Late Submission Fee (LSF).

-

For delays beyond 3 years, the matter must be compounded under FEMA.

4. Post-LSF Action by RBI

-

Once the LSF is paid, the concerned Regional Office (RO) of RBI will update the status on the FIRMS Portal.

-

The applicant is notified via system-generated email.

5. Rejection Remarks Made Transparent

-

Communicated via automated email, and

-

Made available on the FIRMS Portal for reference.

-

In case of rejection, reasons are:

Therefore after all above cited new changes or new updates, RBI has taken significant steps to improve the efficiency and transparency of foreign investment reporting:

- No more redundant FC-GPR filings

- Timely updates and acknowledgments

- Clear workflows for delayed filings

- Improved the user experience on FIRMS Portal

Now, Professionals and companies are advised to leverage these features effectively, remain vigilant of deadlines, and maintain comprehensive documentation to ensure full FEMA compliance on time by filing FG-GPR reporting for FDI in case of any Foreign WOS company Registration process or Investment in an Indian company by foreign nationals.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_Second_Amendment_Rules,_2025_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_learn_crop10_thumb.jpg)

_rd_roc_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpeg)